Frankfurt and London-listed Tui AG (DE:TUI1) (GB:TUI) is considering delisting from the U.K. bourse as the board of directors sees advantages to a simplified, single listing structure. Tui’s board recommends that shareholders vote in favour of the London delisting agenda at the Annual General Meeting set for February 13.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Germany-based TUI Group is one of the largest leisure, travel, and tourism companies in the world. The group operates 400 hotels and resorts, 16 cruise ships, five airlines with more than 130 modern medium and long-haul aircraft, and around 1,200 travel agencies.

Board’s Rationale for Delisting from London

Tui’s Board believes that the single listing structure would be more economical. Their decision is supported by the rationale that roughly 77% of the trading in Tui shares takes place via the German share register and less than 25% is carried out in the U.K. listed shares. The company has witnessed a “significant liquidity migration from England to Germany in recent years.”

Meanwhile, Tui’s shareholders had also questioned whether the dual structure was “optimal and advantageous” during the last annual meeting. After thorough consideration, the board has decided that it is more beneficial to have the Frankfurt listing as its primary listing and try for inclusion in the MDAX, which focuses on mid-cap businesses. Should the vote come in favor, Tui will delist from the London Stock Exchange in June 2024. The resolution would require at least 75% of votes in favor of the motion.

Last month, Tui reported stellar performance in its fourth quarter and full-year Fiscal 2023 results. In FY23, Tui’s revenues jumped 25% year-over-year while underlying EBIT (earnings before interest and tax) more than doubled. The company is enjoying the post-pandemic pick-up in travel demand across all its core businesses. Going ahead, it expects a 25% increase in its underlying EBIT for Fiscal 2024.

Is TUI a Good Investment?

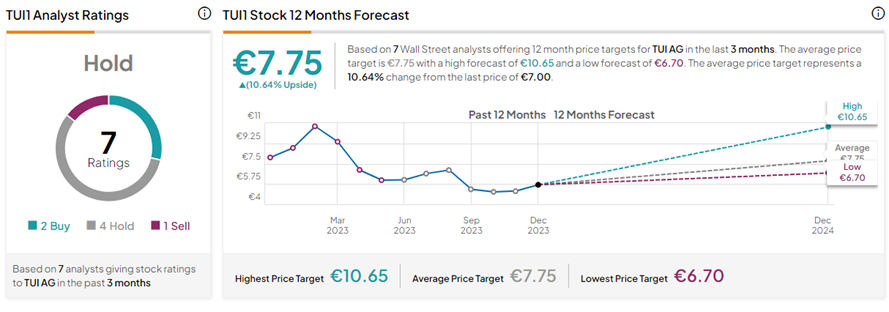

Despite the solid Fiscal 2024 print and rosy outlook, analysts prefer to remain on the sidelines for the moment. Recently, Bernstein analyst Richard Clarke stuck to a Hold rating on TUI1 shares with a price target of €6.80, implying a 2.9% downside potential from current levels.

On TipRanks, TUI1 stock has a Hold consensus rating based on two Buys, four Holds, and one Sell rating. The Tui Group share price forecast of €7.75 implies 10.6% upside potential from current levels. TUI1 shares have lost 19.2% in the past year.