UK-based Tesco PLC (GB:TSCO) and DS Smith (GB:SMDS) have earned Strong Buy ratings from analysts. Tesco exhibits the potential for a 16% increase in its share price, whereas Flutter presents a significantly higher growth opportunity of 30%.

Let’s take a look at the details.

Tesco PLC

Tesco is a famous UK-based retail company that supplies a wide range of products, including groceries, consumables, cosmetics, etc., to customers in the UK and Central Europe.

In its full-year earnings for 2023, the company posted lower profits, but its top and bottom line figures exceeded analysts’ projections. The decline in profits was mainly due to higher food and labor costs and lower sales of non-food items. This impacted the overall margins, which are expected to stay lower in the short term.

Analysts still remain highly bullish on the stock, as profits were expected to be lower in the inflationary environment. They believe the company still holds a strong position as UK’s leading retail company.

Post results, Nick Coulter from Citigroup reiterated his Buy rating on the stock, predicting an upside of 21.6% in the share price.

Tesco Stock Price Target

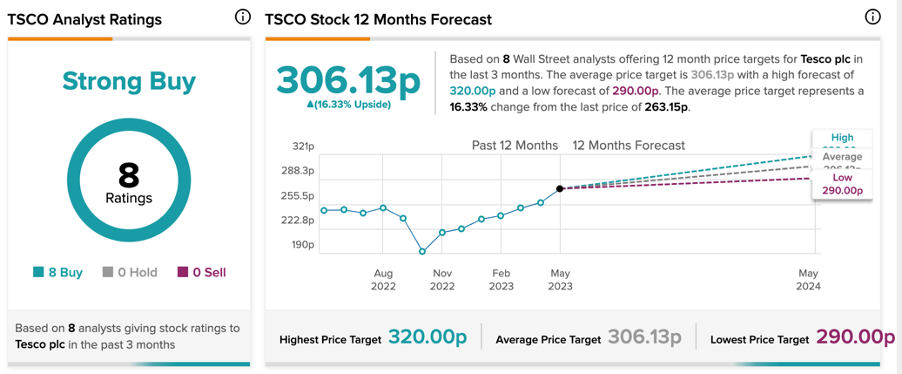

According to TipRanks’ analyst consensus, TSCO stock has a Strong Buy rating with all eight Buy recommendations.

The average price target is 306.13p, which is 16.3% higher than the current price level. The price has a high forecast of 320p and a low forecast of 290p.

DS Smith PLC

DS Smith is a leading manufacturing company that provides sustainable packaging solutions to various industries. DS Smith is known for its expertise in corrugated packaging and operates in multiple countries, serving customers worldwide. YTD, the stock had declined by almost 4%, following a gain of 8% over the past year.

The company is set to report its 2023 earnings on June 22, and analysts anticipate a continuation of its positive profitability trend. In the short term, analysts also expect some risk associated with weaker economic conditions. However, considering a long-term perspective, the company is likely to benefit from the favorable conditions driven by the growth of e-commerce and the growing emphasis on sustainability.

Is DS Smith Stock a Buy?

SMDS stock has a Strong Buy rating on TipRanks backed by three Buy and one Hold recommendations.

The average target price is 411.25p, which represents a growth of 30.7% on the current price level.

Conclusion

Analysts have given their approval to these two British shares and have rated them as Strong Buy.