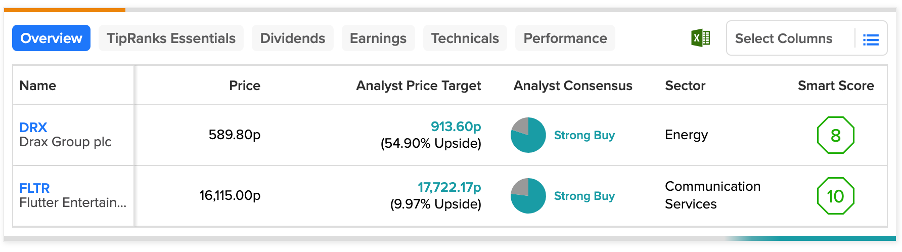

UK-based Drax Group (GB:DRX) and Flutter Entertainment (GB:FLTR) have earned Strong Buy ratings from analysts. Drax demonstrates significant potential for over 50% growth in its share price, while Flutter, already trading at higher levels, offers a modest growth opportunity of 10%.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Let’s take a look at the details.

Drax Group PLC

Drax Group is a power company involved in renewable power generation, sustainable biomass production, and providing renewable electricity to businesses.

In its first-quarter trading update, the company recorded strong power generation, keeping its EBITDA in line with estimates. It announced a £150 million share buyback, which started in the second quarter of 2023. The company’s stock also remains an attractive opportunity for income investors with its higher dividends. In April, the company declared a final dividend of 12.6p per share, taking the total dividend for 2022 to 21p per share. This is higher than the payment of 18.8p in 2021.

Overall, analysts are highly bullish on the company’s prospects and predict huge growth in the share price. Six days ago, Dominic Nash from Barclays confirmed his Buy rating on the stock. His price target of 1,150p suggests a huge upside of 95% on the current share price. Nash is a five-star-rated analyst on TipRanks with a success rate of 70%.

Are Drax Shares a Good Buy?

According to TipRanks’ analyst consensus, DRX stock has a Strong Buy rating with four Buy and one Hold recommendations.

The average price target is 913.6p, which is 55% higher than the current price level. The price has a high forecast of 1,150p and a low forecast of 628p.

Flutter Entertainment PLC

Flutter is a renowned gaming and sports betting company that owns popular brands like FanDuel, Sportsbet, Betfair, and PokerStars within its portfolio.

The company’s stock had a good run in trading and has gained 66% in the last year. While analysts maintain confidence in the stock, the growth potential of the share price is relatively constrained due to elevated trading levels.

In May, the company announced its first-quarter numbers for 2023, with a 29% jump in its revenues. The company’s revenues increased by a solid 92% in the U.S. market, driven by its brand, Fanduel. The revenues in UKI also recovered sharply and grew by 17% after getting hit by government measures last year.

Five days ago, UBS analyst Louise Wiseur reiterated her Buy rating on the stock, predicting an upside of 14.2% in the share price.

Is Flutter Entertainment a Good Investment?

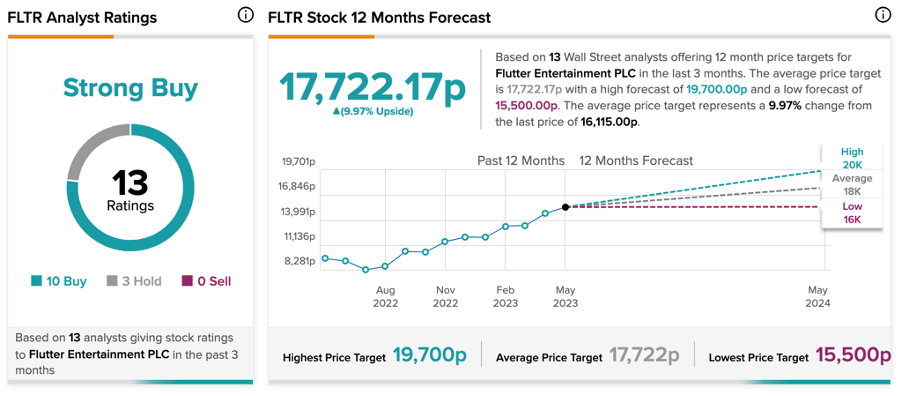

FLTR stock has a Strong Buy rating on TipRanks backed by a total of 13 recommendations, of which 10 are Buy.

The average target price is 17,722.17p, which represents a growth of 10% on the current price level.

Conclusion

Analysts have assigned positive ratings to both DRX and FLTR based on their recently reported financial figures. The Strong Buy ratings provided by analysts indicate that there is still further potential for growth.