Analyst recommendations are the perfect helping hand for investors venturing into a new market. With their industry knowledge and expertise, their ratings can be relied on to make sound portfolio decisions.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Logistics company Deutsche Post (DE:DPW) and real-estate firm Vonovia (DE:VNA) have analysts’ confidence in their stocks. According to analysts, these companies have more than 15% upside potential in their share prices.

The strong earnings growth and stable dividend payments make analysts bullish on these stocks.

The Trending Stocks tool from TipRanks is perfect for choosing stocks from a particular market. This tool provides the stocks that have been recently rated by analysts. This is a guide for investors to pick such stocks and conduct more in-depth research to make the right decision.

Let’s have a look at these companies.

Deutsche Post DHL Group

Deutsche Post is among the largest logistics companies in the world. It enjoys a huge competitive advantage along with its stable earnings.

The analysts favor the stock for mainly two reasons: first, its stable business operations, and second, its dividend payments.

In the Q3 of 2022, the company posted a growth of 20% on its revenues of €24 billion. The profits for the quarter grew by 15% to €2.04 billion, as compared to €17 billion in the prior-year quarter. The company’s international business segment continued to drive its numbers, increasing by 21.8% in the third quarter.

With such numbers, the company proved its efficiency by performing well even with falling demand and declining freight rates. The company’s brand value and pricing power enable it to navigate smoothly through the challenges.

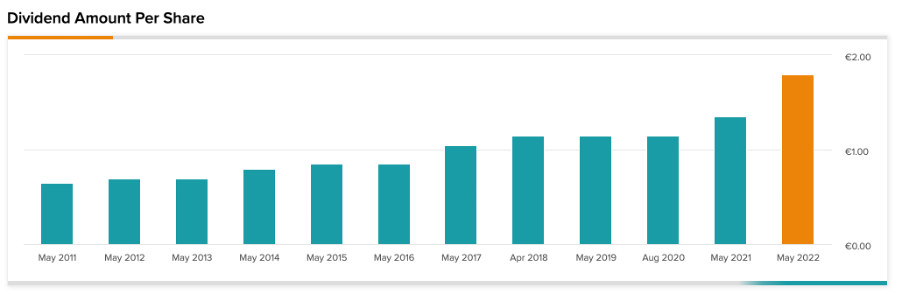

The company is known for increasing its dividend payments over a period of time. Its solid financial position makes its dividends safe and fully covered by earnings. The free cash flow during the last quarter was €1.8 billion, showing a growth of 44%.

The company’s dividend of €1.8 per share in 2021 indicates a payout ratio of 43.6%. It has a dividend yield of 4.94%, against the industry average of 1.6%.

Is Deutsche Post Stock a Buy?

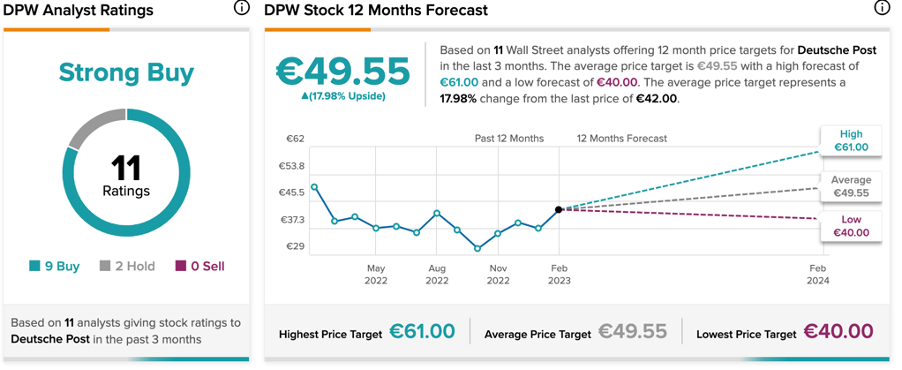

According to TipRanks, DPW stock has a Strong Buy rating, based on nine Buy and two Hold recommendations.

The stock has been trading down by 16% in the last year, and analysts see this as a good entry point. The average target price of the stock is €49.5, which has an upside of 18% on the current price level. The target price ranges from a high of €61 to a low of €40.

Vonovia SE

Vonovia is a real estate company in Germany with expertise in the residential sector.

Similarly to Deutsche Post, Vonovia Stock is also backed by a solid earnings record and dividend payments.

For the first nine months of 2022, the company’s sales increased by 31% to €4.6 billion despite challenging housing market conditions. During this period, the company completed 1500 flats, which was 13% higher than the previous year. The company is targeting a much faster competition process for its projects in 2023, as the labor shortages are expected to ease.

Talking about dividends, the company has a yield of 6.02%, which makes it one of the top dividend-paying companies in Germany.

Is Vonovia a Buy?

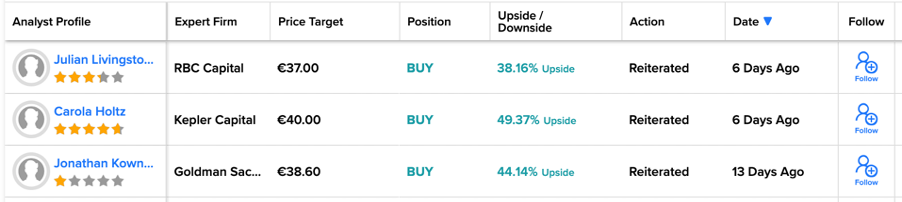

The stock has lost around 42% of its value in the last year. Recently, a few analysts have reiterated their Buy ratings on the stock. Analyst Julian Livingston-Booth from RBC Capital forecasts a 38% upside in the stock price. Booth believes the upcoming earnings in March 2023 will be above expectations.

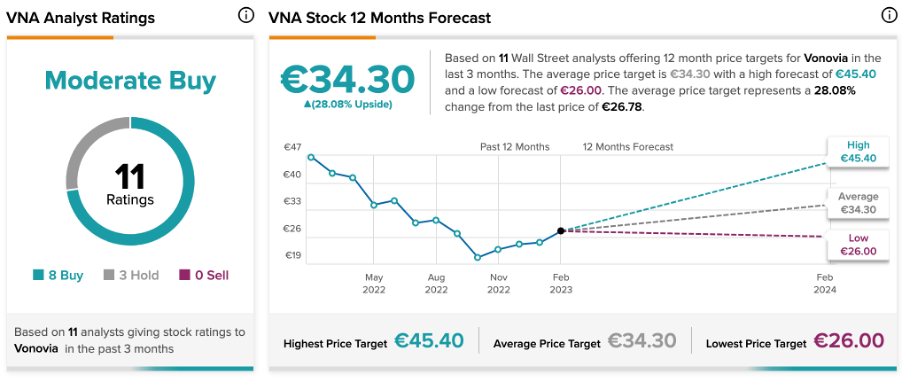

According to TipRanks, Vonovia stock has a Moderate Buy rating, based on a total of 11 recommendations. The average target price is €34.30, which is 28% higher than the current price.

Conclusion

Both of these companies have demonstrated their ability to deliver in difficult economic conditions over time. Analysts expect this trend to continue and are confident in these stocks.