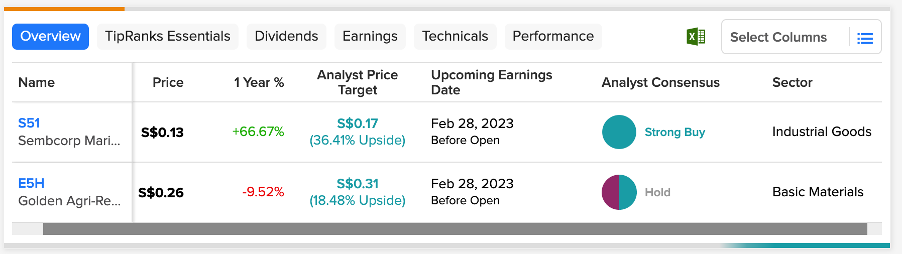

Golden Agri-Resources (GAR) (SG:E5H) and Sembcorp Marine (SG:S51) will announce their full-year earnings for 2022 next week.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Analysts are favoring Sembcorp stock on a long-term horizon, even if the 2022 numbers are expected to be slightly on the lower side. The company’s top line is expected to grow in 2023 and 2024, driven by its project line-up and strong order book after the recently closed merger deal with Keppel.

Agribusiness giant GAR is expected to post higher earnings similarly along the lines of its previous quarters. The stock, on the other hand, has mixed views from analysts.

The TipRanks Earnings Calendar lets you track the upcoming earnings dates of companies across seven different markets. Using this tool, investors can take full advantage of the ongoing earnings season and choose stocks for further research.

Let’s have a look at these companies in detail.

Golden Agri-Resources Ltd. (GAR)

GAR is an agribusiness company with one of the world’s largest palm oil plantations. The company has a wide range of palm oil products, available in around 100 countries worldwide.

The company will report its Q4 and full-year results for 2022 on February 28. According to TipRanks, the consensus EPS forecast is S$0.02 per share for Q4, which is lower than the EPS of S$0.03 in the prior-year quarter.

Analysts feel the overall palm oil industry outlook remains promising, and the plantation players in Singapore will post earnings in line with expectations. For the quarter, the expected sales forecast for GAR is S$6.4 billion.

In the first nine months of 2022, the company delivered a solid performance with a 62% jump in EBITDA to $1.3 billion. The earnings were mainly driven by higher palm oil prices, which are expected to continue and drive more profits for the company.

Golden Agri-Resources Share Price Forecast

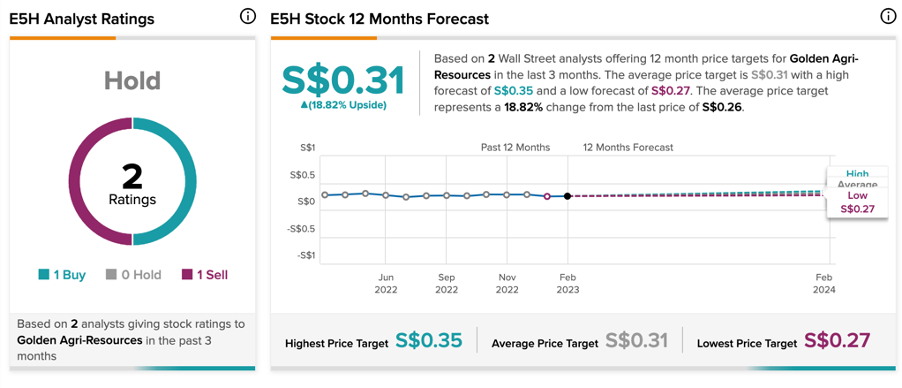

According to TipRanks’ rating consensus, E5H stock has a Hold rating.

The average target price is S$0.31, which indicates an upside potential of 18.8% from the current price level.

Sembcorp Marine Limited

Sembcorp Marine is a global engineering group that provides a complete range of solutions to the marine and energy sectors.

The stock has made its shareholders happy with a return of almost 60% in the last year. The company has had a great year in operations and also closed its merger deal with Keppel Corporation (SG:BN4) to acquire Keppel O&M. The deal has significantly raised the order book value of the company, which has made analysts confident in the stock. The expected combined order book value is around S$18 billion.

Sembcorp will announce its 2022 full-year results on Tuesday, February 28.

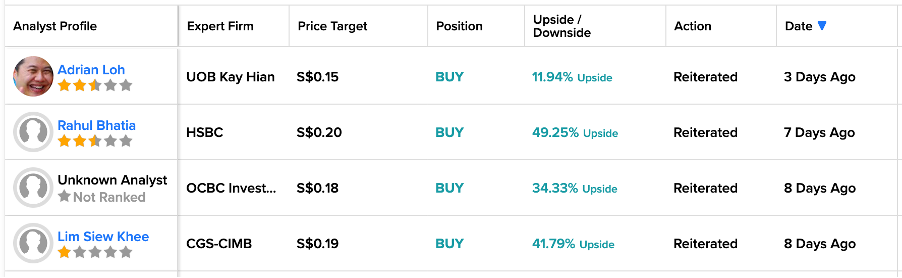

Ahead of its earnings, analyst Adrian Loh from UOB Kay Hian reiterated his Buy rating on the stock. He believes that post-merger, Sembcorp will become a highly competitive company with a greater focus on renewable energy. Moreover, the recent volatility in share prices could lead to an attractive buying opportunity for investors.

Is Sembcorp Marine a Good Buy?

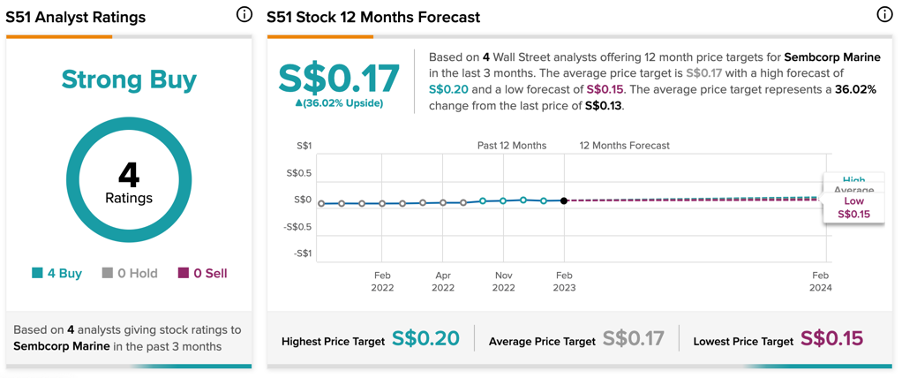

Sembcorp stock has a Strong Buy rating on TipRanks, based on four Buy recommendations.

The target price for S51 is S$0.17, which implies an upside potential of 36% from the current price level. The target price ranges from a low of S$0.15 to a high of S$0.20.

Conclusion

Analysts remain highly bullish on Sembcorp stock based on its merger deal and a strong order book for the future. However, the merger will boost the numbers from 2023 onward, and analysts expect slightly weaker earnings for 2022.

For GAR, analysts expect the higher earnings momentum to continue in the last quarter of 2022. However, the share price offers only a decent upside at the moment.