Shares of German lender Deutsche Bank AG (DE:DBK) were up 5% as of writing, thanks to better-than-feared profits for the fourth quarter of 2023. Plus, the bank announced job cuts as part of its cost-cutting drive and increased shareholder returns through buybacks and dividend hikes. In Q4, profit attributable to shareholders fell 30% year-over-year to €1.26 billion but was way higher than the consensus estimate of around €786 million.

Importantly, DBK plans to increase the total shareholder returns by at least 50% in Fiscal 2024. It intends to complete share buybacks worth €675 million in the first half of this year. For 2023, DBK plans to recommend dividends of €900 million or €0.45 per share (up 50% compared to Fiscal 2022) at the upcoming Annual General Meeting in May. Meanwhile, DBK could increase its dividends to €1 per share in 2025, subject to meeting its financial targets and 50% payout ratio.

Details of DBK’s Financial Performance

In Q4, DBK’s net revenues rose 5% year-over-year while profit before tax fell 10%. This means that revenue growth could not match up with the expense growth.

For Fiscal 2023, profit attributable to shareholders declined by 16% to €4.21 billion due to higher tax expense. However, the figure exceeded analysts’ profit estimate of about €3.69 billion. Revenues rose 6% annually. Importantly, profit before tax grew 2% to €5.7 billion, reaching its highest level in 16 years.

Deutsche Bank is struggling to contain its expenses. Hence, it has announced massive job cuts of non-client-facing roles. DBK is cutting 3,500 jobs from the back-office roles. Under its €2.5 billion operational efficiency programme, the company has already achieved €900 million in savings. DBK hopes to achieve remaining cost savings of €1.6 billion from technology and infrastructure efficiencies. The programme aims to reach a cost base of €5 billion at a quarterly adjusted run rate, with FY 2025 costs falling to €20 billion.

Looking ahead, DBK increased its 2025 revenue goal to €32 billion, as it exceeded its targets in the past two fiscal years. Plus, it aims to return a total of €8 billion to shareholders over the years to boost the stock price.

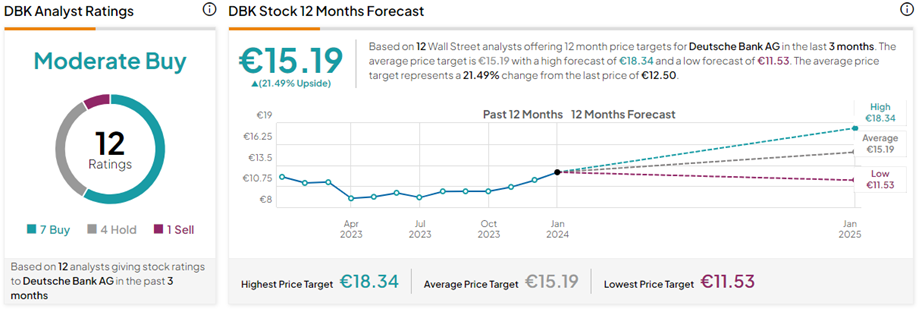

What is the Price Target for Deutsche Bank?

Following the news, J.P. Morgan analyst Kian Abouhoussein reiterated a Buy rating on DBK with a price target of €14.20 (13.6% upside).

Overall, with seven Buys, four Holds, and one Sell rating on TipRanks, DBK stock has a Moderate Buy consensus rating. The Deutsche Bank AG share price forecast of €15.19 implies 21.5% upside potential from current levels.