Siemens Energy AG’s (DE:ENR) shares witnessed a sharp decline last week after the company announced the continuation of problems in its wind turbine segment, Siemens Gamesa. The company’s management also stated that the huge amount of time and money required to address these issues led to the withdrawal of its profit guidance. The company has estimated that addressing the issues will require a cost exceeding €1 billion.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

This led to panic among investors, pushing the shares down by more than 35% on Friday. YTD, the stock has been trading down by almost 16%.

Siemens Energy is a global energy company engaged in the development of wind turbines, gas turbines, gas engines, steam turbines, and other systems. The company spun off from Siemens Group AG (DE:SIE) in 2020. The group company’s stock has traded down by 3.19% in the last five days.

New Ratings

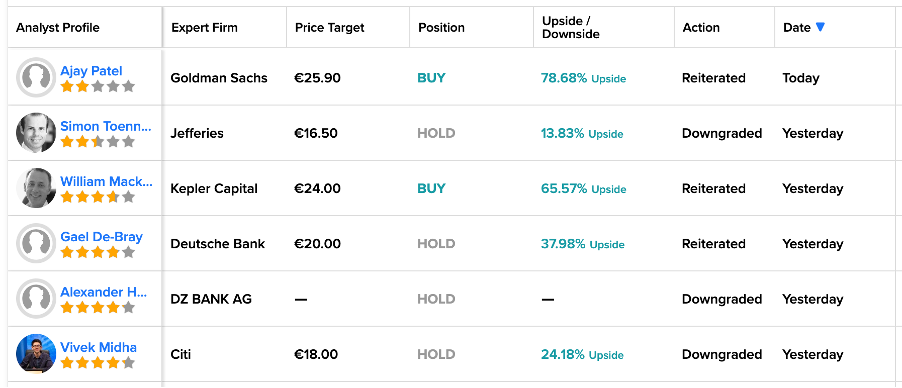

Moving ahead, analysts still hold a bullish take on the stock and predict a huge upside in the share price. However, the recent sell-off triggered target price reductions and rating downgrades from analysts, considering more significant challenges than anticipated within its wind turbine division.

Today, Ajay Patel from Goldman Sachs reiterated his Buy rating on the stock, predicting an upside of 78% in the share price. The share moved into the recovery zone after Patel kept his bullish take on the stock, mentioning the problems as “overblown.” Patel also mentioned that the shares are “deeply discounted” now, creating an attractive opportunity for investors.

Yesterday, Jefferies’ analyst Simon Toennessen downgraded his rating on the stock from Buy to Hold.

On the same day, William Mackie from Kepler Capital reduced its price target on the stock from €26.0 to €24.0 while confirming his Buy rating. This implies a growth rate of 65% in the share price from the current level.

Yesterday, Deutsche Bank also reiterated its Hold rating on the stock, while analysts at DZ Bank and Citigroup downgraded their ratings from Buy to Hold.

Is Siemens Energy Stock a Buy?

Overall, ENR stock has a Moderate Buy rating on TipRanks, with a total of 13 recommendations, of which eight are Buy. At an average price forecast of €25.32, analysts are predicting a change of 73.8% in the share price.

Conclusion

Even though the shares of Siemens Energy suffered a significant blow, analysts are viewing the stock as a cheaper option for investors. On the flip side, investors’ confidence has been hit mainly due to a lack of visibility within the company.