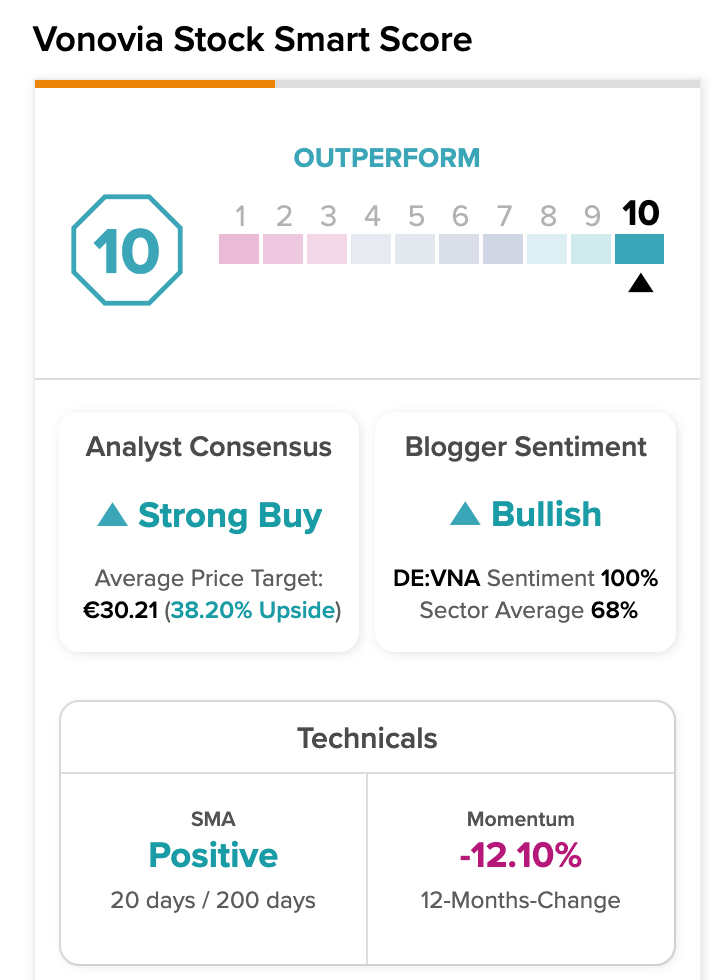

DAX 40 constituent Vonovia SE (DE:VNA) scored a “Perfect 10 on the TipRanks Smart Score tool. It entered the list six days ago, signaling a higher probability that the stock will outperform market benchmarks. Analysts have assigned the stock a Strong Buy rating and anticipate a potential 40% increase in its share price.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Amidst the current uncertainty, TipRanks’ Smart Score Tool can guide investors in making wise investment choices. This exclusive tool assesses critical factors such as analyst evaluations, hedge fund activity, insider transactions, and various fundamental and technical indicators to assign a stock a rating between 1 and 10. This aids investors in distinguishing strong investments from weaker ones, enabling well-informed decision-making.

Vonovia is a prominent player in the European residential real estate sector. The company has established itself as a leader by offering high-quality rental residences across Germany and Austria.

Let’s take a look at the details.

Analysts’ Backing

It’s not solely the Smart Score that highlights the suitability of Vonovia’s stock. Analysts are also bullish on the stock and have identified it as a potential winner.

Over the last month, analysts have confirmed their Buy ratings on the stock, mainly driven by its Q2 earnings report. The company’s results have been robust, particularly in regard to its rental segment, which accounts for approximately 90% of the company’s adjusted EBITDA.

Vonovia’s rental division remains exceptionally steady, boasting an occupancy rate of nearly 98% and highly foreseeable rent increments ranging from 3% to 3.5%. In Q2, the company’s core rental business grew by 10%. The company has maintained its dominant position in the German market through ongoing consolidation efforts. This favorable progress is underpinned by a strong level of customer satisfaction and an enduring demand for residential properties in urban areas.

Following the results, there was a lot of favorable action around the stock. Most recently, yesterday, Bart Gysens from Morgan Stanley upgraded his rating to Hold on the stock.

Seven days ago, analyst Jonathan Kownator from Goldman Sachs reiterated his Buy rating on the stock, predicting an upside of 66% in the share price.

Similarly, Julian Livingston-Booth from RBC Capital also recommended Buying the stock, as he foresees a 50% growth in the share price.

Is Vonovia a Good Stock to Buy?

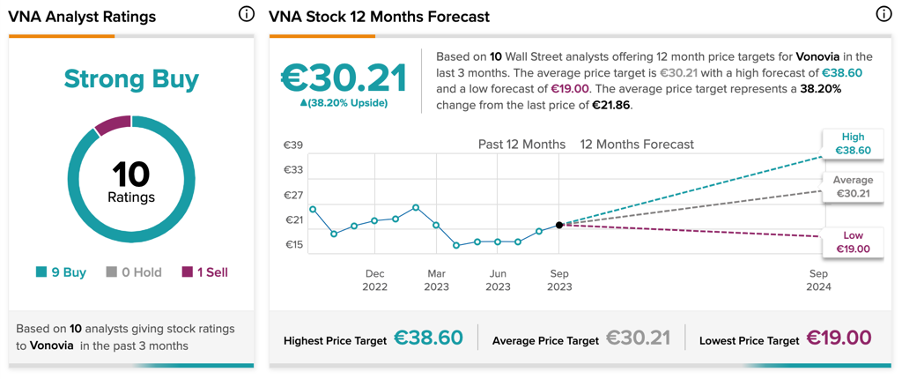

According to TipRanks’ analyst consensus, VNA stock has a Strong Buy rating. The stock has a total of 10 recommendations from analysts, of which nine are Buy. The Vonovia share price forecast is €30.21, which is 38.2% higher than the current price level.

Ending Notes

Vonovia has delivered another impressive quarter, marked by a strong rental business. The company maintains a positive outlook for the remainder of the year. Being featured on the “Perfect 10” list in the Smart Score, coupled with positive ratings, further bolsters the investment argument.