DAX 40 companies SAP SE (DE:SAP) and Sartorius AG (DE:SRT3) will announce their Q2 earnings for the fiscal year 2023 this week. Analysts have assigned a consensus Buy rating to these stocks and expressed optimism regarding their share price growth.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

When it comes to earnings-related information, the TipRanks Earnings Calendar serves as a comprehensive resource. This tool covers seven different markets and provides a schedule of upcoming company earnings arranged by date. Users can conveniently access further details such as analysts’ forecasts, earnings data, stock analysis, and more by simply clicking on the respective stocks.

Let’s take a look at the details.

SAP SE

Based in Germany, SAP is a multinational software and technology company offering a diverse array of enterprise solutions.

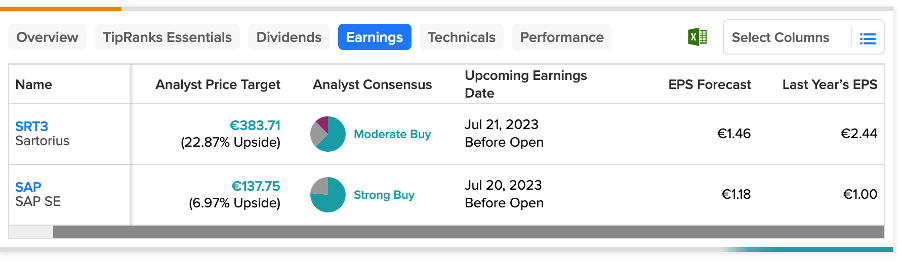

The company will report its second quarter and half-yearly earnings for 2023 on Thursday, July 20. For the quarter, the forecasted EPS is €1.18 per share, higher than the EPS of €0.96 reported in the same quarter of 2022. The company is confident of posting another set of favorable results, continuing its trend from the first quarter. SAP maintained its full-year outlook with an expected acceleration of both topline and operating profit growth.

Analysts expect the company’s sales to be around €7.59 billion for the quarter and are mainly bullish on its cloud revenue, which is expected to increase by 25%. Additionally, the cloud backlog is expected to grow by up to 80%, indicating customers’ confidence in picking S/4HANA for the future.

Is SAP a Good Stock to Buy Now?

According to TipRanks’ analyst consensus, SAP stock has a Strong Buy rating, backed by a total of 17 recommendations. It includes 13 Buy and four Hold ratings. The average forecast is €137.75, which has an upside of 7%.

Sartorius AG

Sartorius is a German company that supplies pharmaceutical and laboratory equipment globally. The company will also report its second-quarter results on July 21. The consensus EPS forecast for the quarter is €1.46 per share, down from €2.44 in Q2 of 2022. The sales forecast for the quarter is around €860 million, as compared to €903 million in the previous quarter.

The company’s shares started the year on an unfavorable note and are trading down by 9% YTD. The shares further plunged in June after the company reduced its earnings forecast due to weakened demand. The company has revised its sales revenue and profitability forecasts for the current year, now expecting a decline in sales revenue within the low to mid-teens percent range, as opposed to previous expectations of slight growth.

In the long term, analysts remain optimistic about the stock and believe the current demand situation is temporary and the company’s fundamentals are strong.

Sartorius Share Forecast

SRT3 stock has a Moderate Buy rating on TipRanks based on a total of eight recommendations, out of which five are Buys.

The average price forecast is €383.7, which is almost 22.8% higher than the current trading level.

Conclusion

Analysts expect a short-term decline in revenue for Sartorius due to lower demand after the pandemic. In terms of share price growth, analysts anticipate more than 20% upside potential with a Moderate Buy rating.

On the contrary, analysts expect SAP to post higher revenue and earnings for the second quarter. However, the share price growth is limited to 7%, along with a Strong Buy rating.