Commerzbank AG (DE:CBK) announced that it has received the regulatory nod to proceed with a share buyback worth €600 million. The bank further stated that all the necessary conditions for buyback have been fulfilled, and the board is expected to come up with more details next month. The stock is trading up by 2.09% at the time of writing today, responding positively to the favourable update.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

This marks the bank’s second buyback initiative, following its first program in June when it repurchased shares for €122 million.

Higher Shareholder Returns

Over the financial years 2022-2024, the bank plans to distribute a total of €3 billion to its shareholders through a combination of dividends and share buybacks.

In September, the bank announced higher returns for its shareholders on the back of improved profitability. The company restructured its investor payout policy, targeting a minimum return of 70% of profit for the year 2024. Additionally, the bank anticipates a payout ratio “well above 50%” for the years 2025 through 2027. This marks an increase from the expected 50% payout, comprising dividends and share buybacks, for the current year.

In November, the bank posted a net profit of €1.8 billion for the first nine months of 2023, up from €963 million a year ago. For the full year 2023, the bank expects to achieve a net profit of around €2.2 billion and RoTE (return on tangible equity) of 7.5%.

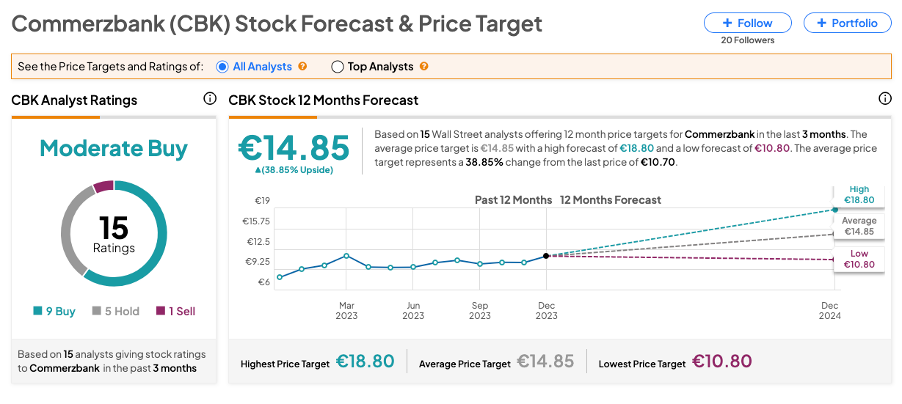

Commerzbank Share Price Forecast

Overall, Commerzbank shares are enjoying a favorable period of trading, driven by a higher interest rate environment. Year-to-date, the stock has recorded a gain of 20%.

CBK stock has received a Moderate Buy consensus rating on TipRanks, backed by nine Buys, five Holds, and one Sell recommendation. The Commerzbank share price forecast is €14.85, which implies a growth of 39% from the current trading level.