Commerzbank AG (DE:CBK) today announced the formation of a new asset management company, Yellowfin, ahead of its earnings report due this week. The bank has separated its current Asset Management segment to create a stand-alone company named Yellowfin Asset Management GmbH. The new company is focused on serving institutional investors, corporate clients, and high-net-worth individuals with managed assets of at least €30 million.

Andreas Neumann, chairman of the management board of Yellowfin, said, “Under the umbrella of Commerzbank, we have found the ideal structure to continue our boutique approach.” He believes that Yellowfin’s business can be scaled with the support of the bank’s functions and sales platform.

The shares reacted negatively after the news and were trading down yesterday. Today, the stock was down by 1.29% at the time of writing. Overall, the shares are having a favorable time in trading, driven by a higher interest rate environment. YTD, the stock has experienced a gain of 25%.

Upcoming Earnings

Commerzbank will publish its first half including the second-quarter earnings report, on Friday, August 4. For Q2, analysts expect the bank to post earnings of €0.51 per share, reflecting growth over the EPS of €0.31 reported in the same quarter last year. The projected sales for the quarter are €2.59 billion as compared to €4.79 billion, in the previous quarter.

The bank is also targeting another buyback for the year after the results. Analysts are favoring the buyback as they feel the shares are heavily undervalued and it will benefit shareholders. This will also help in improving the return on tangible equity (ROTE), which is an apt measure of the bank’s profitability. Commerzbank is aiming to achieve a ROTE of over 10% as part of its new financial targets.

For the fiscal year 2023, analysts are expecting a 50% growth in the bank’s profits to €2.2 billion, fueled by higher interest rates and a multiyear cost-cutting plan. This plan includes cutting costs via the closure of German branches and reducing employees.

On the other hand, investors will closely monitor the bank’s Polish mortgage portfolio, which could pose a risk in the half-yearly results. The bank anticipates a significant financial impact, possibly in the “three-digit million euros amount,” if required to refund interest payments to its clients by its subsidiary, mBank, in Poland. As of now, Commerzbank has already paid out a total of €300 million and set aside an additional €1.4 billion in provisions.

Commerzbank Share Price Forecast

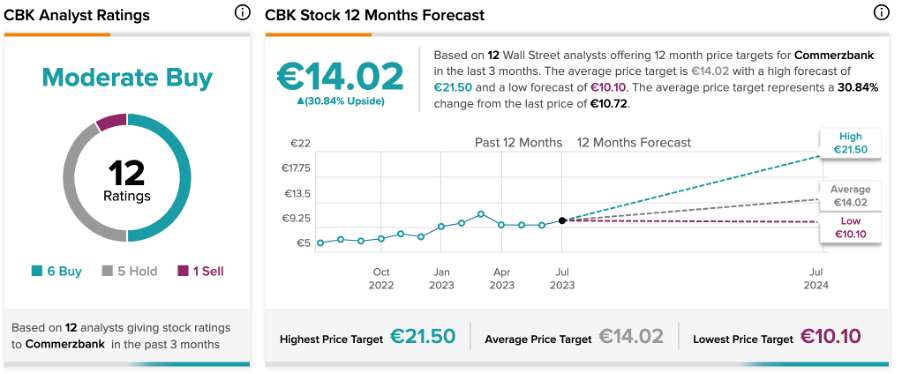

Yesterday, Andreas Plaesier from Warburg Research reiterated his Buy rating on the stock, predicting an increase of 20% in the share price.

CBK stock has a Moderate Buy rating on TipRanks, backed by six Buy, five Hold, and one sell recommendations. The average price forecast is €14.02, which implies a growth of 30% from the current trading level.