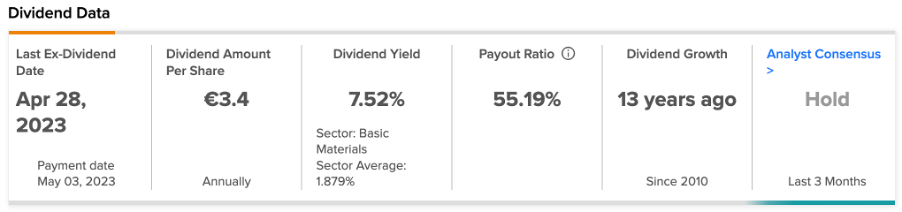

BASF SE (DE:BAS) has an attractive dividend yield of 7.5%, as compared to the sector average of 1.8%. BASF is a constituent of the DivDAX share index, which comprises the 15 companies with the highest dividend yield among the DAX 40 constituents.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

In terms of share price growth, BAS stock has a Hold rating from analysts, who predict a modest hike in the share price. In the past year, the company’s stock has shown volatility and generated a return of 14.4%.

BASF is a leading chemical manufacturing company based in Europe. Its core activities involve manufacturing, marketing, and selling a diverse range of products, including chemicals, plastics, crop protection products, and performance products.

Is BASF a Good Dividend Stock?

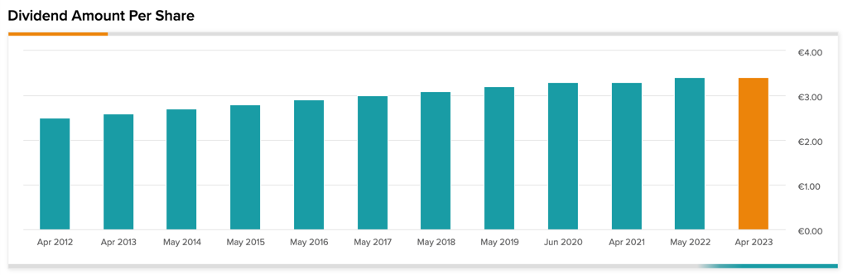

In May 2023, the company paid a dividend of €3.4 per share for 2022, similar to the levels of the previous year. Over the past years, BASF has consistently maintained and even increased its dividend, rising from €2.60 in 2012 to €3.40 in 2022. The average annual dividend growth has been around 3%. The company stated that the amount of dividends paid in the future will be contingent on cash flows after accounting for investments.

On the flip side, analysts remain concerned over the rising debt for the company, which could be a possible threat to growing dividends.

What is the Target Price of BASF Stock?

According to analysts, the company is likely to face short-term disruptions as a result of the ongoing economic slowdown and margin pressures.

Two days ago, Sebastian Satz from Barclays confirmed his Hold rating on the stock, predicting a higher upside potential of 28% in the share price.

Similarly, six days ago, Berenberg Bank analyst Sebastian Bray also maintained his Hold rating on the stock at a modest upside of 5.17%.

According to TipRanks’ analyst consensus, BAS stock has a Hold rating based on a total of 15 recommendations, of which four are Buys. The average price target is €51.41, which shows a growth of 8% from the current price level.

Ending Thoughts

Investing in stocks with growing dividend payouts provides the advantage of rising dividend income over time. Moreover, such companies typically demonstrate robust fundamentals, including strong earnings growth and profitability.