Allianz SE (DE:ALV) is a well-established insurance company headquartered in Germany and has a global reach across over 70 countries. The company offers a diverse range of insurance and asset management solutions.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

In the last six months, the stock has been trading up by 18% after underperforming the market in the last year. During the second half of the previous year, the stock showed some signs of stability and put on a modest performance.

Moving forward, analysts remain cautiously bullish on the company and believe the higher interest rates will lead to a more positive turnaround. The cherry on top is the company’s dividend policy.

Let’s take a look at some details.

Tempting Dividends

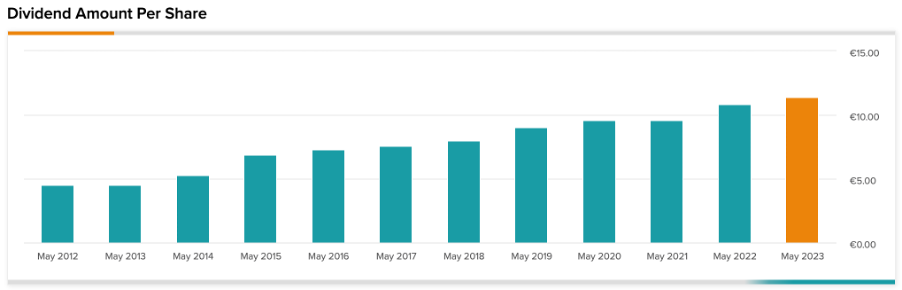

Allianz has maintained a record of distributing dividends on a regular basis, and the amount of such payments has increased over the years. The company’s existing dividend yield stands at 4.84%, which is notably higher than the industry average of 2.1%.

The company announced a dividend of €11.4 per share for 2022, which is payable on May 9. This amounted to a growth of 5.6%, as compared to the payment of €10.8 in the previous year.

The company’s management is confident of an annual increase of at least 5% in its dividends in the coming years. As a result, it is expected that the dividend will be a minimum of €12.00 in fiscal year 2023 and €12.60 in 2024.

A Positive Outlook for 2023

In 2022, the company made an operating profit of €14.2 billion, representing a growth of 5.7% from the previous year. Moving ahead, the company is expecting to maintain a similar level of operating profits in 2023.

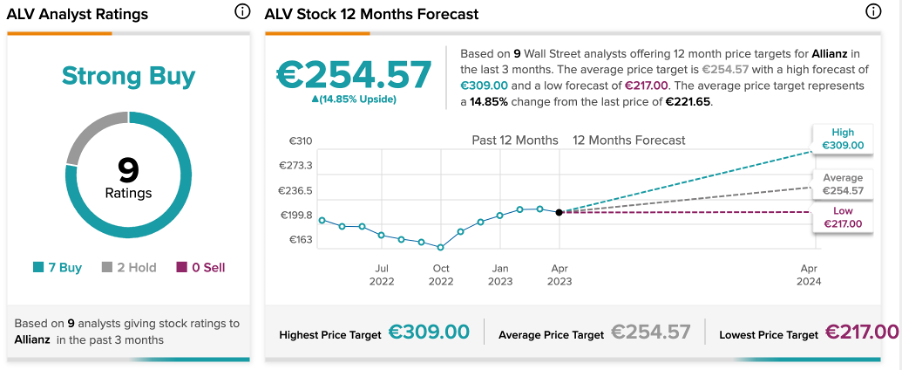

As the company prepares to announce its first-quarter earnings for 2023 on May 12, analysts have confirmed their Buy ratings for the stock.

Today, Berenberg Bank’s analyst Michael Huttner reiterated his Buy rating with a predicted upside of almost 40%. Huttner has the highest price target on the stock.

Yesterday, analyst Hadley Cohen from Deutsche Bank reiterated his Buy rating on the stock and forecasted growth of 16%.

What is the Price Prediction for Allianz Stock?

According to TipRanks’ rating consensus, ALV stock has a Strong Buy rating. The projected average price for Allianz is €254.6, indicating a 14.8% change from its present value.

Conclusion

In 2022, Allianz showed remarkable resilience, which has made investors and analysts bullish on the stock. Even though analysts are cautious about the 2023 earnings for financial sector companies, a majority of them have thus far reported robust figures.

Allianz presents an appealing option for investors, considering its stable dividend policy and a Strong Buy rating from analysts.