Italian spirits distiller Davide Campari-Milano SpA (IT:CPR) is expanding its cognac portfolio by buying Courvoisier from Japanese spirits manufacturer Beam Suntory (DE:7SNU). Campari has agreed to pay a whopping $1.32 billion for Courvoisier when the demand for global spirit consumption is declining. Campari believes that the decline is temporary and that spirit sales are set to rebound soon. CPR stock is up 2.2% on the news today.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

The deal includes a fixed purchase price of $1.2 billion and earn-out of up to $0.12 billion payable in 2029, contingent on net sales targets set for Fiscal 2028.

Davide Campari-Milano, trading as Campari Group, produces spirits, wines, and non-alcoholic apéritifs. Some of its notable offerings include Aperol, Appleton, Cinzano, SKYY vodka, Wild Turkey, Grand Marnier, and Forty Creek whisky.

Here’s Why Campari is Buying Courvoisier

Courvoisier is one of the largest cognac producers in the world, and Campari is pleased to buy this premium brand. The acquisition also helps Campari’s ambition to establish its footprint in the U.S. distillery market. Notably, roughly 60% of Courvoisier’s sales come from the U.S., paving the way for Campari to enter the market easily. The addition of Courvoisier will increase Campari’s distilling infrastructure as well as bottling and warehousing capabilities in the Cognac space.

Campari CEO Bob Kunze-Concewitz noted that Courvoisier will be added to its existing offerings of Bisquit cognac and Grand Marnier. Further, Courvoisier is expected to make roughly 8% of total sales once the acquisition is fully completed.

The COVID-19 pandemic, followed by a tight monetary environment, has dug a hole in consumers’ pockets. Moreover, inflationary conditions and high interest rates led spirit makers to increase the prices of drinks. Nonetheless, Kunze-Concewitz believes that cognac has become a drink of choice in the U.S. and will see its sales revive going ahead.

Is Campari a Good Company?

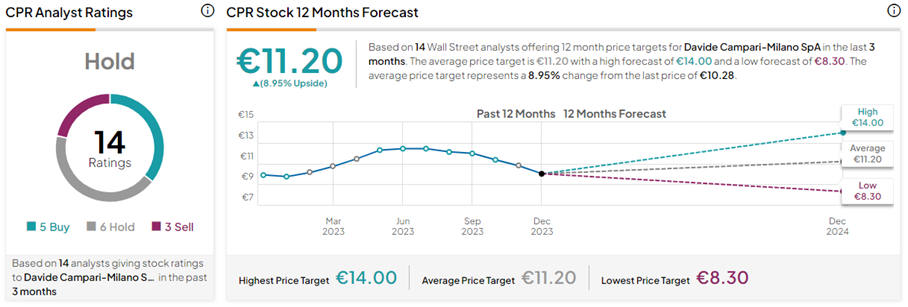

On TipRanks, CPR stock has a Hold consensus rating based on five Buys, six Holds, and three Sell ratings. The Davide Campari-Milano share price target of €11.20 implies a nearly 9% upside potential from current levels. Year-to-date, CPR shares have gained 8.1%.