The ASX-listed companies CSL (AU:CSL) and Computershare Limited (AU:CPU) will announce their first-half results for the fiscal year 2023 this week. Experts are highly bullish on CSL’s earnings, as the company recovered from the COVID-19 setbacks and its revenues are on track to exceed the pre-pandemic levels.

For Computershare, the company is looking at higher revenues and earnings, sitting on an improved margin income due to higher interest rates in the economy.

Overall, the stocks have a ‘Strong Buy’ rating from analysts.

Investors could use the TipRanks Earnings Calendar for the Australian market to stay updated on all the upcoming earnings this month.

Let’s have a look at these companies in detail.

CSL Ltd.

CSL is a biotechnology company that develops products in three segments: rare and serious diseases, influenza vaccines, and iron deficiency and nephrology. It is the third-largest company on the ASX 200.

CSL will report its half-yearly results for the fiscal year 2023 on February 14. Analysts remain positive about the company’s Behring business, its plasma collections, and its hold on the influenza vaccine market. The consensus EPS forecast for the quarter is AU$5.05, which shows a growth of 35% on the EPS of AU$3.76 in the same quarter last year.

Analysts expect CSL’s earnings to be highly driven by its improved plasma collections. Plasma is used in many therapies, which accounts for half of the company’s sales. The company also started a new plasma processing plant in December, which will push its processing by nine times. This is a significant tailwind for the company’s earnings in the coming years.

The full-year net profits are expected to be in the range of $2.7 to $2.8 billion, of which $1.65 billion will be accounted for in the first half. The expected interim dividend for the first half is $1.08 per share.

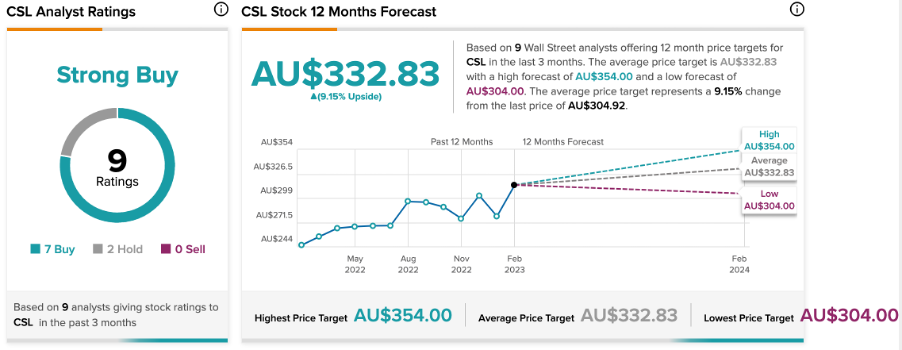

CSL Share Price Target

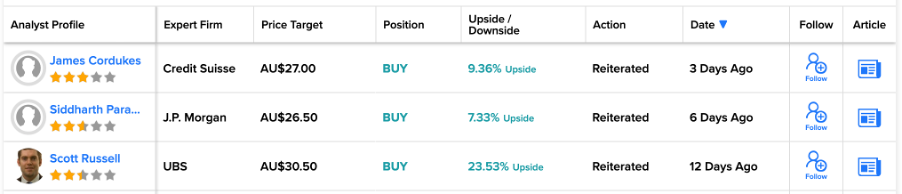

Ahead of its earnings, the majority of analysts have reiterated their Buy ratings on the stock. Overall, CSL stock has a Strong Buy rating on TipRanks.

Most recently, analyst Shane Storey from Wilsons maintained the Buy rating on the stock, with a potential upside of 13.14%.

The average target price for the stock is AU$332.83, which is 9.15% higher than the current price level.

Computershare Limited

Computershare primarily provides corporate governance and proxy services, stock registration, shareholder services, etc. to the listed companies.

The company will report its Q2 and first-half results for the fiscal year 2023 on February 15. According to TipRanks, the consensus EPS forecast for the quarter is AU$0.68, much higher than the EPS of AU$0.23 for the Q2 in the previous year.

The company posted $186.5 million of margin income for the full year 2022, which was 74.3% higher than in 2021. In 2023, analysts believe the company’s margin income will further drive earnings growth. The full-year margin income is expected to be around $800 million, which was increased after previous guidance. The company’s YTD performance for the year 2023 is already ahead of expectations as margin income continues to grow.

Analysts are also bullish on the stock price and have reiterated their Buy ratings on the stock ahead of its earnings.

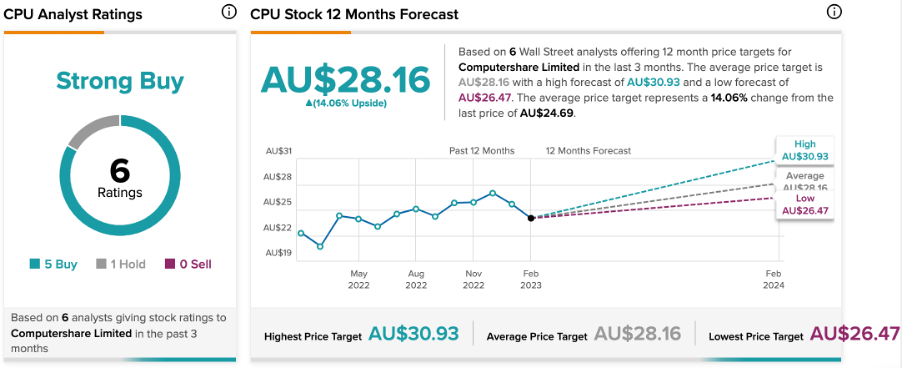

Computershare Share Price Forecast

The shares are trading down by 4.12% in the last three months. However, the long-term prospects remain bullish with a Strong Buy rating on TipRanks.

The average CPU price forecast is AU$28.16, which has an upside of 14.06%.

Conclusion

Investors are optimistic as they wait for CSL results, with higher revenues and profits expected. The company will report solid numbers driven by the Vifor acquisition, plasma collection growth, and new product approvals.

For Computershare, analysts are bullish on the company’s earnings based on the higher growth expected in its margin income.