Shares of London-based Crest Nicholson Holdings PLC (GB:CRST) are down 4.8% as of writing following a trading update by the homebuilder that revealed lower profit expectations. For the full year ending October 31, 2023, CRST reported incremental costs of £11 million related to the construction of legacy sites at Brightwells Yard, Farnham. Owing to the increased costs, Crest Nicholson now expects adjusted profit before tax for Fiscal 2023 to be £41 million.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Crest Nicholson is a British real estate company focusing on single-family housing, apartments, and townhome complexes. The construction company operates mainly in the southern half of England. CRST shares have lost over 22% in the past year.

Reduced Profit Guidance

Crest Nicholson’s revised profit guidance represents a massive 70% decline from the Fiscal 2022 figure of £137.8 million. Moreover, the company expects an additional one-time, non-cash charge of £13 million related to a legal claim. A fire damaged a low-rise apartment block in 2021, for which the company has to bear the losses now. The company will provide further details of this claim in its preliminary full-year results scheduled on January 23, 2024.

Meanwhile, the company noted that there has been an upward trend in customer interest and inquiries in 2024, as mortgage rates have started to decline. This is expected to benefit the construction company, with the demand for homes expected to increase amid an overall positive sentiment for the housing market.

What is the Prediction for Crest Nicholson’s Share Price?

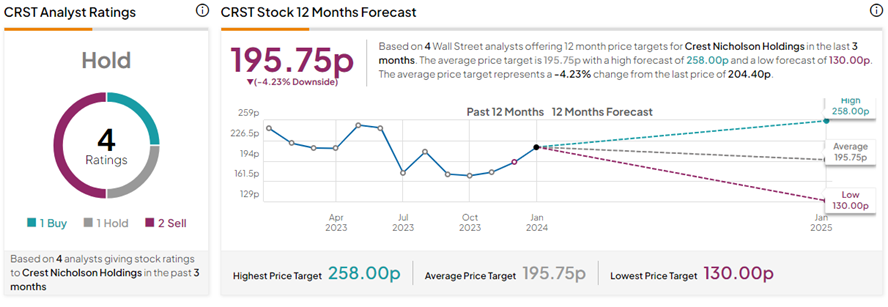

On January 8, Barclays analyst Emily Biddulph upgraded CRST stock to Buy from Sell. Moreover, the analyst lifted the price target on the stock to 258p (25.2% upside potential) from 200p.

On TipRanks, the Crest Nicholson share price target of 195.75p implies 4.2% downside potential from current levels. Also, CRST stock has a Hold consensus rating backed by one Buy, one Hold, and two Sell ratings.