DAX 40, the benchmark index for German equities, has started the year 2023 on a favorable note. YTD, the index has been trading up by almost 13%.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

German manufacturing companies Continental AG (DE:CON) and Rheinmetall AG (DE:RHM) have surpassed the overall market returns in 2023 so far. YTD, Rheinmetall gained more than 35%, while Continental has been trading up by 19%. According to analysts, moving forward, these companies offer only a slight upside in their share prices, as they are already trading at higher values.

Let’s have a look at these companies in detail.

Rheinmetall AG

Rheinmetall is a German manufacturing company that designs arms and automation products for global markets.

Since Russia’s invasion of Ukraine in 2022, the company’s stock has reached new heights and gained almost 400% in the last three years. The increased defense spending pushed the company to become a part of the DAX 40 index in March 2023.

Moving ahead, the company expects solid growth for its products in 2023, driven by higher military budgets and spending by countries in Europe. Recently, the company received a contract from the German government to supply around 140 Leopard battle tanks to Ukraine in installments.

Rheinmetall’s order backlog is strong at €26.6 million as of December 2022, which was a new record for the company. It expects this number to grow to €40 billion by 2024.

Is Rheinmetall a Good Stock to Buy?

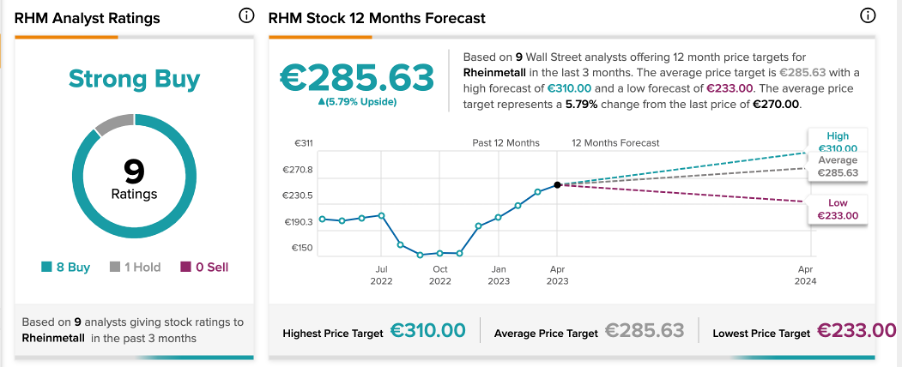

According to TipRanks, RHM stock has a Strong Buy rating, based on eight Buy and one Hold recommendations.

With an average price forecast of €285.6, the stock has a small upside of 6% from the current trading levels. The price has a low and high forecast of €233 and €310, respectively.

Continental AG

Continental is a manufacturing company dealing in tyres and automotive parts that operates in 57 countries worldwide. Over the last six months, the company’s stock has gained 40%.

In March, the company reported its 2022 earnings with improved numbers. The total sales grew by 16.7% during the year to €39.4 billion, as compared to €33.8 billion in 2021. The order intake in its automotive segment increased by 26% to €23 billion.

For 2023, the company expects higher sales of €42 billion to €45 billion based on the recovery in the global automotive sector. The numbers are based on the expected increase in the production of cars and light commercial vehicles.

On the flip side, higher costs like raw materials, labor, and energy will continue to pose a threat to annual income.

Continental Share Price Forecast

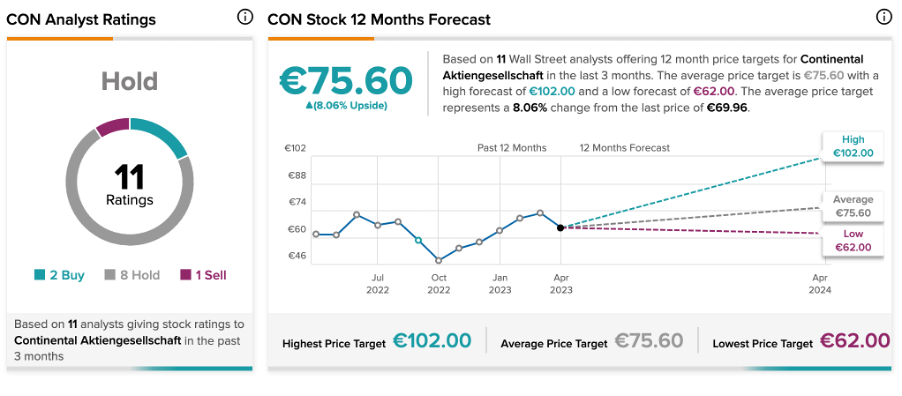

CON stock has mixed opinions from analysts on TipRanks, with an overall Hold rating. The average price prediction for the next year is €75.6, which is 8% higher than the current price.

Conclusion

DAX 40 companies RHM and CON had a fruitful year, which was reflected in higher share prices. The companies are confident about further growth in 2023, however, the shares offer limited upside to investors.