The Commonwealth Bank of Australia (AU:CBA), or CommBank, is among the four major Australian banks, offering an extensive range of financial services. After touching a high point of AU$108 in February 2023, the stock has remained volatile and has lost 1.71% in the last three months. Overall, the share price has been down by almost 3.5% in the last year.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Recently, in May, the stock experienced a sharp fall after the news of the collapse of another U.S. bank, First Republic Bank. As expected, the CBA share price was also hit by the prevailing negative sentiment in the industry.

According to analysts, shareholders may need to depend on dividends for their returns as the bank faces challenges due to an economic slowdown and declining house prices.

What is the Interim Dividend for CBA 2023?

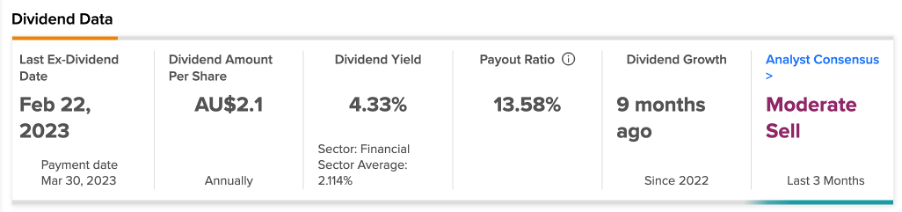

CommBank is known for its stable dividend payments, making it an apt choice for income investors. The bank has maintained a track record of consistently paying biannual dividends. It paid an interim dividend of AU$2.10 per share for 2023. This led to a dividend yield of 4.3% for the bank, which is above the sector average of 2.11%.

The total dividend for 2022 was AU$3.85 per share, which is expected to grow to AU$4.50 per share in 2023. This represents stellar growth of almost 17% in the bank’s dividends.

CBA Stock Price Prediction

In terms of capital growth, CBA stock has a Moderate Sell rating on TipRanks based on a total of 11 recommendations. This includes seven Sell and four Hold ratings.

The stock has an average price target of AU$90.23, which is 7.28% lower than the current price.

Conclusion

Even though analysts recommend selling the stock as it does not offer any capital appreciation, CBA could be a good choice for income-oriented investors.