ASX-listed companies Coles Group (AU:COL) and Wesfarmers Limited (AU:WES) are famous among investors for their dividends. Despite their less favorable share price growth, these companies remain dedicated to enhancing the returns for their shareholders.

In terms of share price growth, both shares do not offer any upside. Coles Group has a Moderate Sell rating from analysts, while Wesfarmers has a Hold rating.

Let’s take a look at these companies in detail.

Coles Group Limited

Coles Group is a well-known retailer in Australia, managing a network of supermarkets, liquor stores, and other retail outlets. The company was formed out of a demerger from Wesfarmers in 2019.

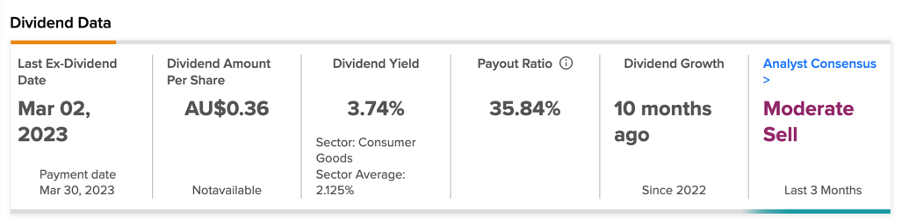

The company has a dividend yield of 3.74%, whereas the sector has an average of just 2.12%. Recognizing the significance of dividend payments to its shareholders, Coles has implemented a dividend policy that targets distribution of over 90% of its underlying earnings annually.

In 2022, the company paid a dividend of AU$0.63 per share. Analysts expect the dividends to grow to AU$0.72 in 2023 and AU$0.77 in 2024.

Coles Share Price Forecast

COL stock has a Moderate Sell rating on TipRanks, based on a total of seven recommendations, of which four are Sell. It also includes one Buy and two Hold ratings.

The average target price is AU$16.67, which is 9.7% lower than the current price level.

The shares have been trading up by almost 14.5% YTD.

Wesfarmers Limited

Wesfarmers is an Australian group company with a diverse range of operations. The company’s businesses include home décor, beauty, pharmacy, retail, apparel, and many more.

The company has established a reputation as a consistent dividend payer on the ASX. At a dividend yield of 4.06%, it looks like an appealing option for investors. In February 2023, the company paid its interim dividend of AU$0.88 per share. For the full year, analysts have predicted a total dividend of AU$1.84 in 2023, higher than the payment of AU$1.8 in 2022. In 2024, this number is expected to rise to AU$1.91.

Analysts also believe that the company could benefit from its businesses in essential products and healthcare in 2023. Moreover, the company has made significant progress with its productivity initiatives to counteract cost pressures.

Is WES a Good Stock to Buy?

According to TipRanks, WES stock has a Hold rating based on two Buy, two Hold, and three Sell recommendations.

The stock’s average price target of AU$48.08 shows a downside of 1.88% from the current levels.

Conclusion

These renowned companies hold prominent positions in the Australian market. Analysts believe that they are facing inflationary pressures, suggesting that it may not be an ideal time for investment. However, for income-oriented investors seeking stable dividends, both WES and COL present suitable options.