China-based Li Ning Co. Limited (HK:2331) has launched a buyback plan of up to HK$3 billion in an effort to revive its share price. Shares fell by around 14% on Monday after the company announced a property acquisition in Hong Kong. This took the year-to-date decline for the stock to over 70%. Shares are trading up by 4% at the time of writing today in reaction to the buyback announcement.

Li Ning is a leading Chinese sports brand, founded by former Olympic gymnast Li Ning. The company manufactures and sells apparel, footwear, and other sports equipment.

Strategic Buyback to Reassure Disappointed Investors

The company announced its agreement to acquire commercial property for HK$2.2 billion from Henderson Land Development Co. Ltd. (HK:0012). Investors were disappointed with the acquisition of this property, which the company plans to designate as its main office in Hong Kong. Investors and analysts are cautious about the company’s capital allocation, given its declining sales and earnings.

Citi analyst Xiaopo Wei stated the property acquisition was “less optimal than special dividends or share buybacks for shareholders.” Wei commented on the buyback, stating, “This is welcomed first share repurchase plan by Li Ning.” Wei has assigned a Buy rating on the stock, predicting a growth rate of over 100%.

The company, on the other hand, stated that the headquarters in Hong Kong represents a crucial milestone, which is expected to boost business growth and enhance brand-building efforts. The company also expressed optimism about the share buyback, considering its share price is undervalued. The planned buyback will be executed on the open market over the next six months.

Is Li Ning Stock a Good Investment?

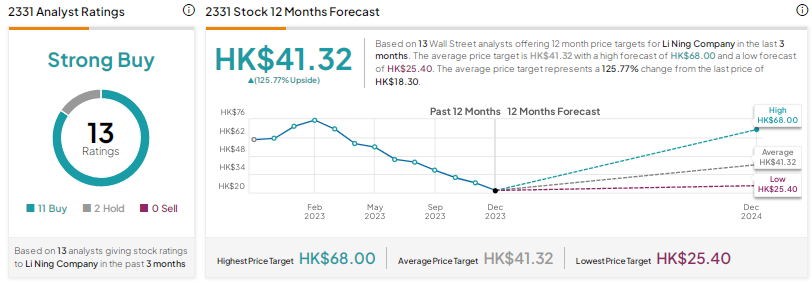

As per TipRanks, 2331 stock has received a Strong Buy consensus rating, supported by 11 Buy and two Hold recommendations. The Li Ning share price forecast stands at HK$41.32, signifying a huge potential upside of 126% in the share price.