UK-based energy companies Centrica PLC (GB:CNA) and SSE PLC (GB:SSE) scored ten out of ten on the TipRanks Smart Score tool. Centrica made it to the list yesterday, while SSE has been part of this club since last month. The “Perfect 10” score suggests a strong likelihood for both stocks to outperform market returns.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Adding to the appeal, analysts have given “Strong Buy” ratings to both stocks.

The TipRanks’ Top Smart Score tool assesses stocks using eight key factors to determine their potential for outperforming the market. These factors include ratings from top-performing analysts, the buying or selling activities of hedge funds, as well as fundamental and technical indicators. Stocks that receive a score of eight or higher are generally expected to outperform the market and deliver superior returns.

Let’s take a closer look at them.

Centrica PLC

Centrica is a renewable energy company that supplies electricity and gas to around 10 million customers in the UK and Ireland. Centrica was added to the “Perfect 10” club yesterday.

The stock has gained 50% in the last year and more than 200% in a longer period of three years. In its earnings report for 2022, the company posted record profits of £3.3 billion, driven by higher energy prices and enhanced production. The better results helped the company restore its dividends after 2019. The total dividends for 2022 were 3p per share.

Moving forward, analysts are still bullish on the stock, considering the company’s strong position in the market and diversified revenue streams. Despite facing challenges from disruptive innovation to political uncertainty, the company has demonstrated resilience and consistently met the demands of customers for reliable energy supply services.

Is Centrica PLC a Good Buy?

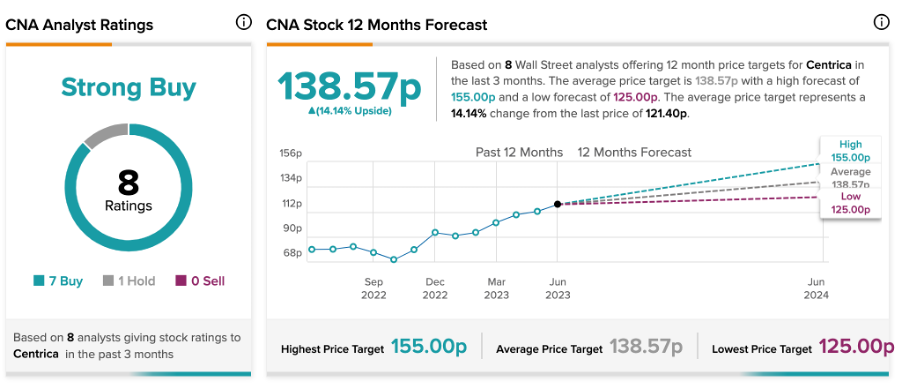

According to TipRanks’ analyst consensus, CNA stock has a Strong Buy rating backed by seven Buy and one Hold recommendations.

The average price target is 138.5p, which is 14.14% higher than the current trading level.

SSE PLC

SSE is also a prominent electricity network company in the UK, actively driving the transition toward renewable energy generation.

The company has been included in the list of top-performing Smart Score stocks since last month. The analysts like the stock due to its strong earnings track record and expect it to continue in the future. Moreover, Its emphasis on the development of renewable energy sources also presents promising prospects.

The company’s stock is also famous among income investors, with a dividend yield of 4.89%. For the full year 2023, the company’s dividends are expected to be around 80.2p per share.

What is the Future Price of SSE Stock?

Based on all six Buy and two Hold recommendations, SSE stock has a Strong Buy rating on TipRanks.

The average price target is 2,140.7p, which implies an upside of 16% from the current levels. The price has a high forecast of 2,500p and a low forecast of 1,785p.

Conclusion

Both Centrica and SSE benefit from their status as major players in the UK energy market and their potential for earnings growth. The combination of top Smart Scores and Strong Buy ratings makes them even more appealing options for investors.