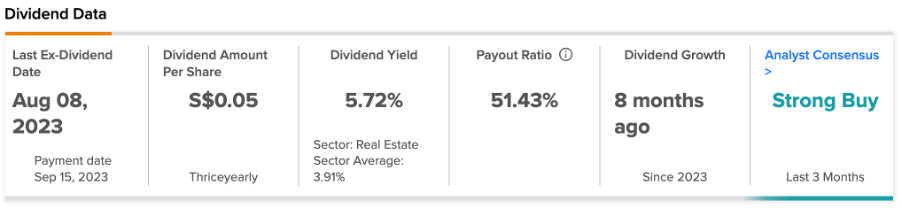

SGX-listed CapitaLand Integrated Commercial Trust, or CICT (SG:C38U), is a highly sought-after dividend stock in the Singapore market. It remains among the top choices for income-focused investors thanks to its impressive dividend yield of 5.72%, significantly surpassing the sector’s average of 3.9%.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Singapore REITs (real estate investment trusts) are subject to a requirement mandating them to distribute a minimum of 90% of their distributable income to unitholders. This regulation is in place to qualify for tax transparency on the amount they distribute to their unitholders. Essentially, it encourages REITs to pass on a significant portion of their earnings to investors.

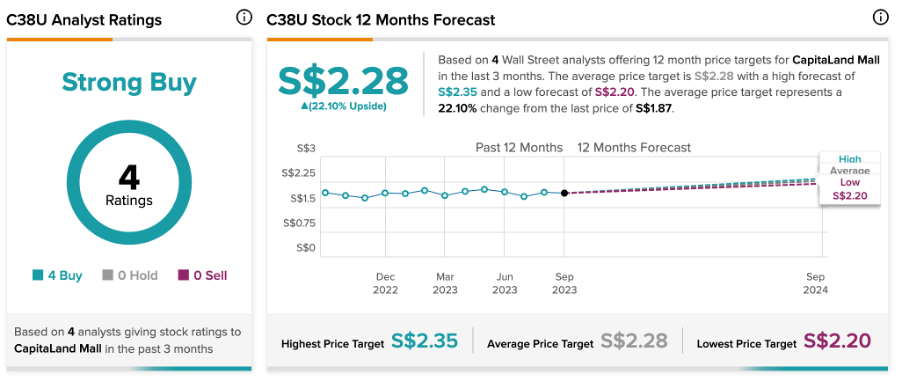

CICT stock also exhibits promising potential for share price growth. Analysts have assigned it a Strong Buy rating, forecasting a growth of over 20% in the share price.

CICT is the oldest and biggest REIT on SGX, investing in commercial properties mainly in Singapore. It also owns a few properties in Germany and Australia. The company underwent a name change in November 2020 from CapitaLand Mall Trust to CapitaLand Integrated Commercial Trust.

CapitaLand Integrated Commercial Trust Dividend 2023

For the first half of 2023, the company declared a DPU (distribution per unit) or dividend of S$0.053 per share, which was paid on September 15. The company recorded a slow growth of 1.5% in its DPU as compared to the payment of S$0.0522 made in 2022. This was mainly attributed to higher borrowing costs due to rising interest rates in the economy. However, analysts maintain a bullish outlook on the company, driven by a portfolio of top-notch office and retail properties that have demonstrated resilience across various economic cycles.

Earnings Support

In July, the company reported its first-half earnings report for 2023, mostly in line with market expectations. The company experienced a significant improvement in both gross revenue and net property income, with a year-on-year increase of 12.7% and 10.1% to S$775 million and S$552 million, respectively. These figures represent 50% and 49% of its full-year estimates.

The numbers reflected the recovery in shopper traffic and tenants in the Singapore market. The recovery has also led to increased leasing demand from retailers, with the trust recording positive rental reversions of 6.9% for the first half of 2023.

Looking ahead, there is potential for further improvement in the trust’s properties, as the recovery of the Chinese tourists was constrained by flight capacity limitations. This is expected to improve over the next 12 months.

What is the Stock Price Forecast for C38U?

According to TipRanks’ rating consensus, C38U stock has received a Strong Buy rating, based on all Buy recommendations from four analysts. The CICT share price target is S$2.28, which is 22.1% higher than the current price level.