Japan’s Canon Inc. (DE:CNNA) (OTHEROTC:CAJPY) has successfully launched its advanced chipmaking machine, which is poised to challenge Dutch rival ASML Holding NV (DE:ASME). Canon has developed a chip-stamping machine that improves the semiconductor production process, making it both easier and substantially cheaper. Instead of ASML’s method of etching chips with EUV (extreme ultraviolet light), Canon’s machine simply stamps the chip designs on silicon wafers.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Canon is a multinational company manufacturing office multifunction devices, copying machines, printers, cameras, and lithography equipment. Canon unveiled the advanced chipmaking machine last October after spending nearly 15 years on its development.

Benefits and Challenges of Canon’s New Machine

As per a Financial Times report, Canon’s “nanoimprint lithography machines” will help reduce the costs of manufacturing chips by minimizing the time and cost of the most expensive part of the process. Furthermore, the new machine is expected to reduce energy consumption by nearly 90%. Canon expects to start shipping the machines as early as this year. The company hopes to capitalize on the current semiconductor boom and artificial intelligence (AI) frenzy.

Notably, ASML is one of the largest manufacturers of semiconductor equipment used to produce some of the most advanced chips in the world. ASML’s market dominance in the semiconductor space is already being challenged by the growing tensions between the U.S. and China and related chip bans. If Canon’s nanoimprint machines disrupt the market, ASML could lose a large share of the most coveted semiconductor market.

Having said that, critics say that Canon’s machine will not do much harm to ASML’s standing. Opponents are saying that if the stamping machines were really that effective and impeccable, such machines would have already flooded the market.

Furthermore, Canon’s new technology would require chip manufacturers to make certain changes in their existing manufacturing process, which currently aligns with the EUV technology.

Indeed, Hiroaki Takeishi, Canon’s Industrial group head, said that manufacturers will be required to add extra equipment for cleaning and mask production. Also, Canon’s technology is currently suitable for only the 5 nanometers (nm) chips and needs more work to reach the 2nm chips. Considering these issues, Takeishi said the initial shipments will be for trial periods. He also stated that Canon does not see the nanoimprint tech as displacing the EUV technology, instead, the two can coexist.

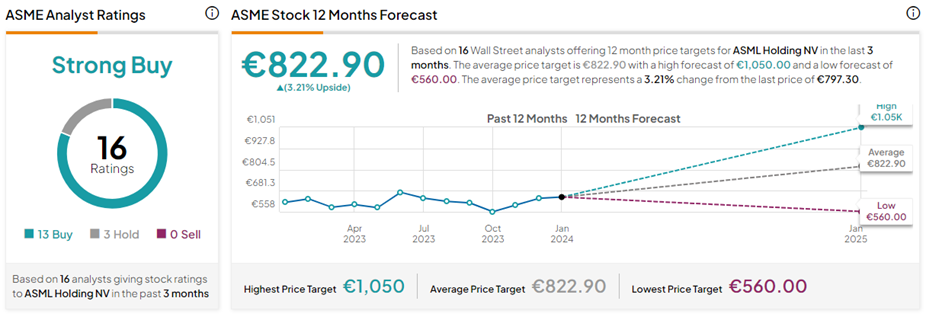

Is ASML a Buy, Sell, or Hold?

Last week, ASML reported better-than-expected Q4 FY23 results but warned of flat sales for Fiscal 2024 owing to the increasing chip bans.

With 13 Buys and three Hold ratings, ASME stock commands a Strong Buy consensus rating on TipRanks. The ASML Holding NV share price forecast of €822.90 implies 3.2% upside potential from current levels.