Metals mining company Central Asia Metals PLC’s (GB:CAML) shares have been trading down by over 30% in the last six months, in line with falling commodity prices. However, analysts remain bullish on the stock, considering its high dividend yield of 10.78% and solid growth potential of over 40% in the share price. They have rated the stock as Strong Buy.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

CAML is a mining company that produces copper, zinc, and lead through its operations in Kazakhstan and North Macedonia. The company is known for its high level of production at a surprisingly low cost.

Let’s see what makes analysts so bullish on the stock.

CAML Dividends

The company remains a top dividend stock with a yield of 10.78%. This is much above its sector average of 1.87%. The company’s dividend strategy aims to distribute to shareholders a portion, ranging from 30% to 50%, of its free cash flow. The company’s cash flow position enhances its dividend appeal for income-oriented investors. The company also achieved a status of zero debt in 2022 while rewarding its shareholders and managing its operations.

For the fiscal year 2022, the company has paid a total dividend of 20p per share, including a final dividend of 10p paid in April 2023. This was similar to the level of dividends paid in 2021.

Analysts Ratings

Analysts remain bullish on the long-term aspects of the company and the share price. They believe the future prospects for copper prices remain promising, particularly considering its crucial role in electric vehicle manufacturing and decarbonization efforts.

20 days ago, RBC Capital analyst Marina Calero reiterated her Buy rating on the stock, predicting an upside of almost 30% in the share price.

Last month, Richard Hatch from Berenberg Bank also recommended Buying the stock, as he sees 50% growth in the share price over the next 12 months. Hatch said the company is among “the lowest-risk, highest-yielding stocks in our coverage” and makes a solid investment case.

Is Central Asia Metals a Good Investment?

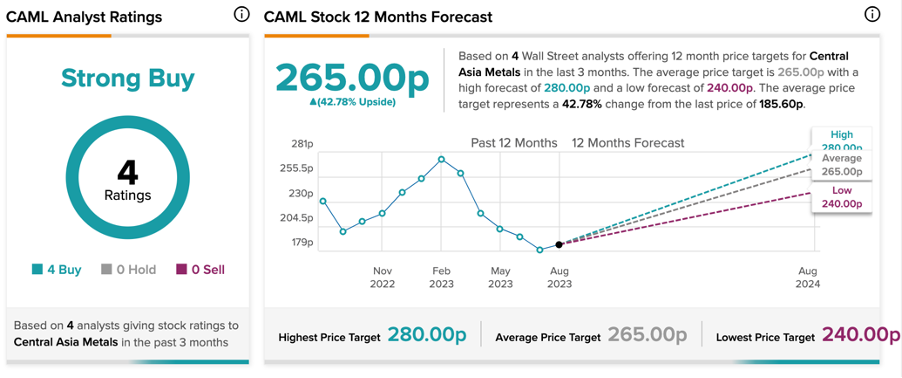

Based on all four Buy recommendations, CAML stock has a Strong Buy rating on TipRanks.

The average price prediction is 265p, which shows a good upside of 42.7% from the current level. The price target has a low and a high forecast of 240p and 280p, respectively.

Ending Thoughts

CAML operates as a cost-effective business that is both profitable and generates cash while also delivering consistent dividends. Analysts hold a bullish opinion about the company and have rated the stock as a Strong Buy.