CaixaBank S.A. (ES:CABK) is a leading financial services group in Spain that offers a range of banking, insurance, asset management, and investment solutions to both individual and corporate clients.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

YTD, the bank’s stock has been trading down by 1.71%, hit by the turbulence in the banking sector in March 2023. Overall, the stock has generated a return of 23% in the last year.

The Technical Perspective

The overall summary of the technical analysis on CABK stock suggests a Buy signal in the time frame of one month. The summary provides technical insights such as oscillators and moving averages, which give an overview of the stock’s technical performance.

For CABK, the Buy rating in the summary is based on 12 bullish, four neutral, and four bearish signals.

According to the moving averages for the one-month period, the stock is considered a Strong Buy. The moving average is a widely used tool for analyzing share price data.

CABK’s 10-day exponential moving average is 3.37, which is lower than the current price level of €3.44, indicating a Buy. The stock’s 100-day exponential average also indicates a Buy.

In contrast to the moving averages, the relative strength index (RSI) of 61.47 indicates a Neutral course of action.

What is the Forecast for CABK Shares?

The bank will announce its first-quarter earnings for 2023 next week, on May 5. The bank posted a jump of almost 30% in its net profits in 2022, to €3.15 billion. In 2022, the lending income grew by 16% to €6.9 billion. The bank expects this to grow by 30% to €9 billion in 2023, driven by higher interest rates and loan yields.

7 days ago, Citigroup analyst Borja Ramirez Segura maintained his Buy rating on the stock at a price target of €4.25, implying an upside of 22%.

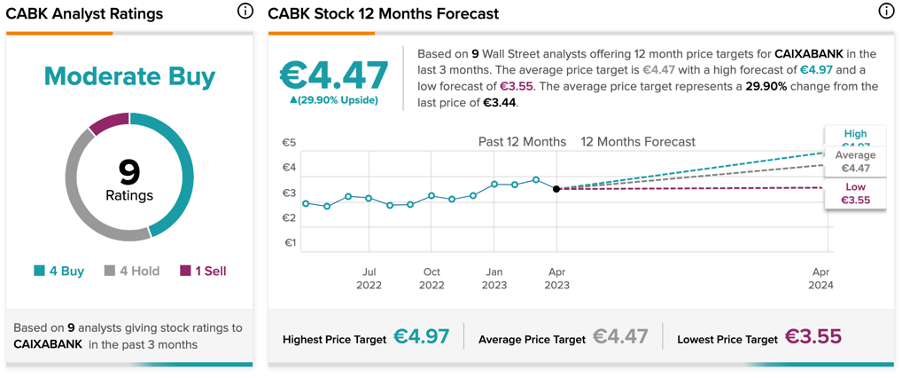

On TipRanks, CABK stock has a Moderate Buy rating based on a total of nine recommendations. It includes four Buy, four Hold, and one Sell ratings.

The stock has an average price target of €4.47, which suggests an upside of 30% on the share price.

Conclusion

CaixaBank could be a favorable inclusion in investment portfolios considering the positive technical indicators and Buy recommendations provided by analysts.