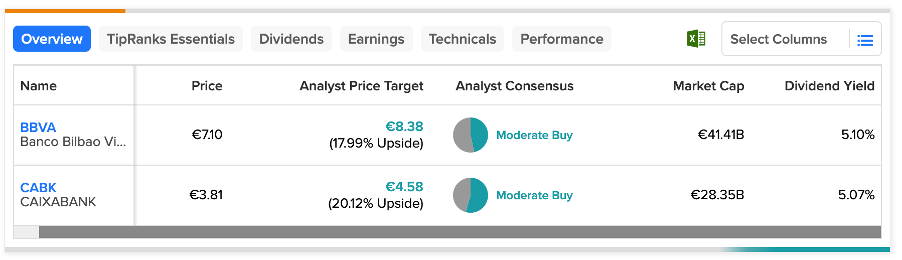

Spanish financial companies Banco Bilbao Vizcaya Argentaria (ES:BBVA) and CaixaBank (ES:CABK) are rated as Moderate Buy by analysts. Both of these stocks offer more than 15% growth in their share prices. These companies also tick the box for income investors with more than 5% of a dividend yield.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Let’s take a look at some details.

Banco Bilbao Vizcaya Argentaria or BBVA

Based in Spain, BBVA is a prominent financial organization, offering a range of services including retail banking, private banking, asset management, and various related solutions.

Analysts are bullish on the stock amid the higher interest rate environment, supporting the bank’s profitability. BBVA posted an increase of 43% in its net interest income in its first quarter earnings of 2023. Furthermore, there was a significant year-over-year increase of 39.4% in net attributable profit, reaching €1.85 billion. The company’s dividend yield of 5.1% surpasses most of its peers in the industry, which has an average of 2.11%. The company’s final dividend for 2022 amounted to €0.31 per share, marking its highest payout in the past 14 years.

Analysts anticipate year-over-year revenue growth of 22.8% for BBVA for its second quarter, reaching $7.64 billion.

Three days ago, Bank of America Securities initiated its Hold rating on the stock, predicting an upside of 12.5% in the share price.

Prior to that, three days ago, UBS analyst Ignacio Cerezo affirmed his Buy rating on the stock with a growth forecast of 27% in the share price.

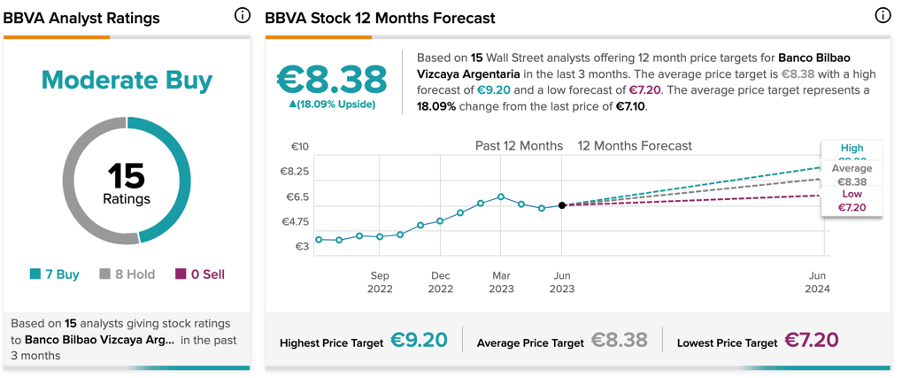

BBVA Share Price Forecast

According to TipRanks, BBVA stock has a Moderate Buy rating with a total of 15 recommendations from analysts. It includes seven Buy and eight Hold ratings. The average price target is €8.38, which is 18% higher than the current price level.

CaixaBank, SA

CaixaBank is also a leading financial services conglomerate in Spain, offering a wide array of banking, insurance, asset management, and investment solutions to individuals and corporations alike.

YTD, the bank’s stock has experienced a modest increase of 8.5% due to the turbulence in the banking sector in March 2023. However, the stock has delivered higher returns of 21% over the past year.

The bank’s dividend yield stands at 5.07%, surpassing the sector average of 2.14%. With its strong position in the balance sheet, the company is well-placed to efficiently distribute surplus capital to its shareholders. Looking ahead, CaixaBank’s dividend is projected to increase to €0.29 per share by 2024, leading to a dividend yield exceeding 8%.

Bank of America Securities also initiated its rating on CABK with a Buy recommendation, predicting an upside of 35%. The price target is set at €5.15.

CaixaBank Share Price Forecast

CABK stock has a Moderate Buy rating on TipRanks, backed by six Buy and five Hold recommendations. The average price target is €4.58, which is 20% higher than the current price level.

Conclusion

Both BBVA and CABK have benefited from the rising interest rates in the economy. Moving forward, analysts are still maintaining a bullish outlook for their stocks.

Moreover, for investors seeking to enhance their passive income, these stocks may be worth exploring as potential additions to their portfolios.