Using the TipRanks Daily Analyst Ratings tool for France, we have identified three stocks: Carrefour SA (FR:CA), LVMH Moet Hennessy Louis Vuitton (FR:MC), and Vivendi (FR:VIV). These stocks have earned Buy rating from analysts today, making them viable options for investment.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Among these stocks, Vivendi offers more than a 50% upside in its share price. while LVMH and Carrefour have more modest growth rates of 13% and 20%, respectively.

Let’s take a look at these shares in detail.

Is Carrefour a Good Investment?

Carrefour is a global retail company with stores in around 30 countries worldwide. The company deals in groceries, electronics, and other food items.

The analysts are bullish on the stock considering its pricing power despite facing lower volumes. The company is also positive about the cost savings plan in response to declining volumes, which could boost margins in the long run.

Today, Izabel Dobreva from Morgan Stanley confirmed her Buy rating on the stock, predicting a growth of 21.4% in the share price.

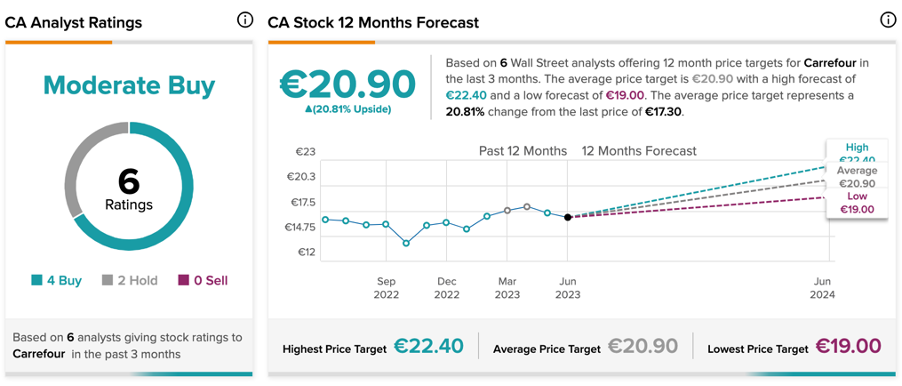

According to TipRanks, CA stock holds a Moderate Buy rating, which is based on four Buy and two Hold recommendations. The average price target of €20.9 indicates a potential increase of 20.8% from the current share price.

Is LVMH Stock a Good Buy?

LVMH is a French luxury company known for its exceptional portfolio of over 75 prestigious brands. The company has the advantage of strong pricing power as its customers value the distinctive products offered by the company.

RBC Capital analyst Piral Dadhania confirmed his Buy rating on the stock today. His price target of €960 suggests a growth rate of 13.21% in the share.

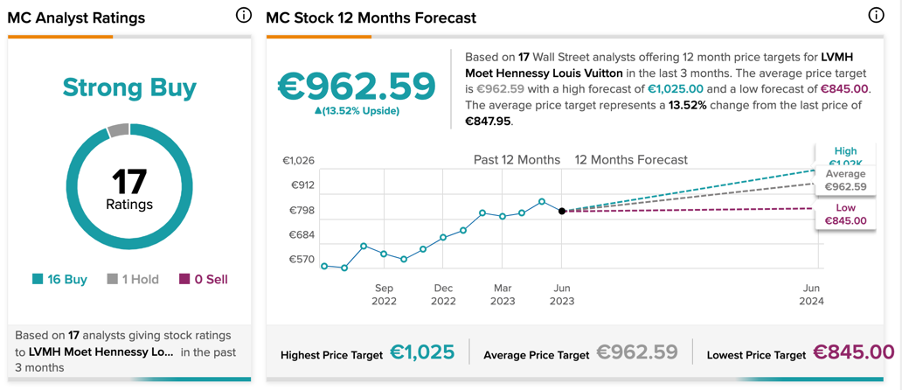

Based on a total of 17 recommendations on TipRanks, MC stock has a Strong Buy rating. It includes 16 Buy and one Hold ratings. The average price forecast of €962.6 is 13.5% above the current trading level.

What is the Forecast for Vivendi?

Vivendi is a media group with operations throughout the media chain. The company’s diversified businesses include TV, gaming, publishing, media, and telecommunications.

VIV stock is assigned a Strong Buy rating on TipRanks, backed by five buy versus one Hold recommendations. The average price forecast of €12.74 indicates a huge growth potential of 51% in the share price.

Matthew J Walker, an analyst from Credit Suisse, upheld his Buy rating on the stock today, projecting a 42.4% increase in the share price. He lowered the price target from €13.1 to €12.0.