Chinese electric vehicle (EV) maker BYD Company Ltd (HK:1211) is investing 100 billion yuan to boost the features of its EV models. CEO Wang Chuanfu announced the investment at the company’s Dream Day event in Shenzhen on January 16, citing the need to beat competition with rivals who offer advanced features. BYD also launched its Xuanji smart car technology at the event.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

The timeline and exact nature of the investment remain unknown at the moment. Despite the good news, 1211 shares are down more than 5% in morning trade today on news of the Chinese economy missing fourth-quarter GDP expectations.

BYD Enhances EV Features to Beat Competition

BYD will install a feature called Navigation on Autopilot in EVs priced at more than 300,000 yuan and will offer an upgrade to EVs priced over 200,000 yuan. This feature that allows the vehicle to go on autopilot mode in certain scenarios is already pre-installed in BYD’s Denza N7 EV. The company plans to add it to the luxury Yangwang brand models.

Moreover, BYD plans to attract buyers by offering a vehicle-mounted drone and housing case in its Yangwang U8 model. Other innovative features include a palm print motion sensor technology to unlock the autos by waving from a distance and the use of steering wheel and pedals as game controllers for virtual racing games.

Overall, BYD aims to maintain the solid demand for its EVs through enhanced features and the new Xuanji smart car system, with competition in the Chinese EV market getting intense. At the event, CEO Chuanfu highlighted that the company has a team of over 4,000 people working on smart driving technology.

BYD’s Export Dreams Get Bigger

Turning toward BYD’s EV export plans, which are set to get bigger, a spokesperson said that the company’s Denza brand will launch in Europe in the fourth quarter of this year. Plus, BYD plans to export its Yangwang and Fang Cheng Bao brands under a new brand name to suit international customers. In 2023, BYD exported roughly 8% of its total sales of 3 million vehicles.

Notably, BYD’s first-ever chartered vehicle vessel set sail on Monday with 5,000 EVs for Europe on board.

What is BYD’s Future Prediction?

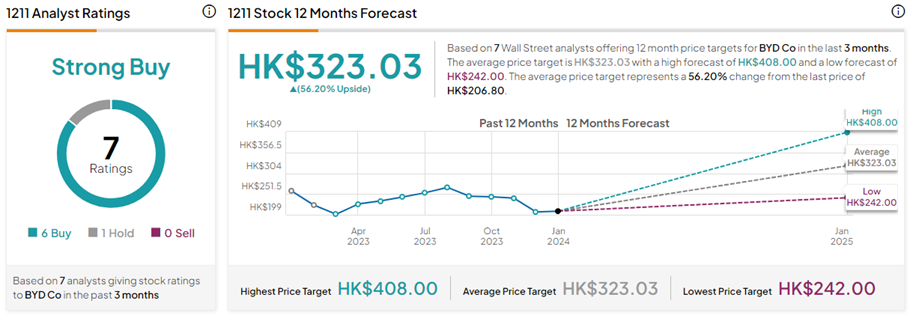

On TipRanks, the BYD Company Ltd share price prediction of HK$323.03 implies 56.2% upside potential from current levels. Also, 1211 stock commands a Strong Buy consensus rating based on six Buys and one Hold rating.