Electric vehicle (EV) maker BYD Co. Limited (HK:1211) is boosting its global expansion plans due to concerns about limited growth in mainland China. The company’s sales in China have remained stagnant over the last two months, hovering at 302,000 units. To date, the company has sold around 200,000 pure electric and hybrid vehicles outside China in around 58 global markets.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Based in China, BYD Co. is among the leading EV manufacturers in the world.

Going Global

So far in 2023, BYD has come really close to EV giant Tesla (NASDAQ:TSLA) in the race to become the world’s largest EV seller by building momentum in its global sales. However, the majority of its sales came from its home market. According to a company filing released yesterday, BYD’s deliveries outside China have accounted for just 3.3% of its total year-to-date volumes, indicating abundant opportunities to expand further.

With growing concerns like overcapacity in the domestic market, Chinese EV players have no choice but to speed up their global expansion. The company is also worried about its sales in China, as the showdown in the economy is impacting consumers’ confidence in purchasing high-end products.

Consequently, BYD is seeking a larger market share globally in addition to its dominance in China by leveraging both exports and local production strategies.

Last month, BYD launched its sedan car Han in the UAE (United Arab Emirates). Its ATTO 3 model is also available for purchase in the UAE. BYD aims to establish its presence in the Middle Eastern markets, given the geopolitical hurdles limiting the entry of Chinese companies into the U.S. and expansion in Europe.

Is BYD Company a Good Stock to Buy?

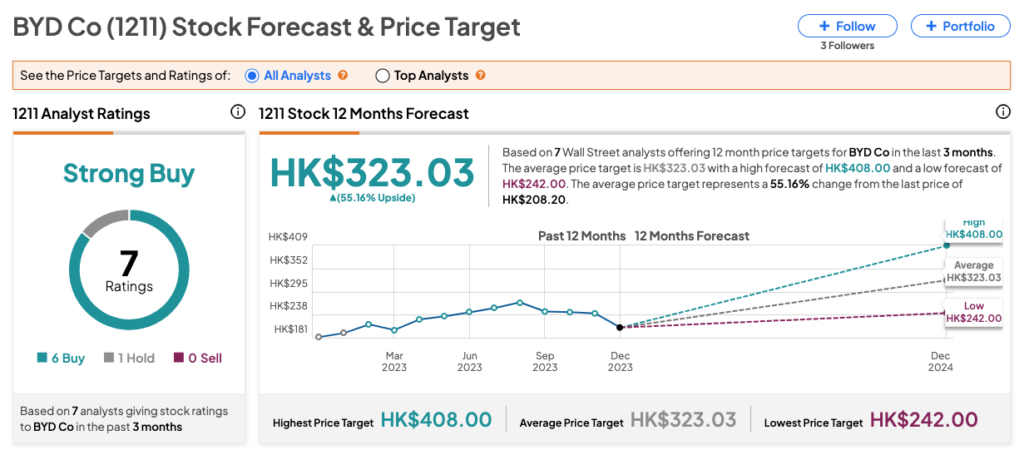

According to TipRanks, 1211 stock has received a Strong Buy consensus rating, backed by a total of seven recommendations, of which six are Buy. The BYD Co. share price target is HK$323.03, which implies an upside of 55% from the current trading level.