Chinese electric vehicle (EV) maker BYD Company (HK:1211) dethroned Tesla (NASDAQ:TSLA) as the top EV company in the final quarter of 2023. However, the Hong Kong-listed shares of BYD have declined nearly 24% in the past year, as investors are worried about the macroeconomic pressures in China and intense competition in the EV market. Nonetheless, analysts remain bullish on BYD shares and expect a significant upside potential.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

BYD’s 2023 Performance

BYD’s vehicle deliveries grew 62% to 3.02 million new energy vehicles (NEVs) in 2023, including more than 1.57 million battery EVs and nearly 1.44 million plug-in hybrid EVs.

The company estimates its 2023 net profit to grow in the range of 74.5% to 86.5% to RMB29 billion to RMB31 billion. The estimated profit range slightly lagged analysts’ expectations, as the company’s discounts and promotional offers to spur volumes amid intense competition weighed on the margins.

Overall, BYD generated impressive NEV deliveries and higher profits in 2023 despite growing rivalry in the Chinese EV market and macro challenges. The company’s expanding international business, enhanced brand power, and cost control initiatives fuelled increased profits last year.

What is the Price Target for BYD Stock?

Following the company’s update about its estimated 2023 earnings, analysts at DBS reiterated a Buy rating on BYD stock with a price target of HK$347. DBS noted that BYD’s preliminary estimates were in line with its expectations.

Coming to 2024, DBS expects BYD’s vehicle sales to increase by around 30%, driven by integrated production and an expanding NEV portfolio. DBS cautioned that increased competition and slower sales growth in the Chinese passenger vehicle market could trigger volatility in 1211 shares over the near term. That said, the firm sees the pullback in BYD stock as a buying opportunity.

Overall, DBS is bullish on BYD stock, given the company’s expansion into the high-end EV market and growing focus on exports.

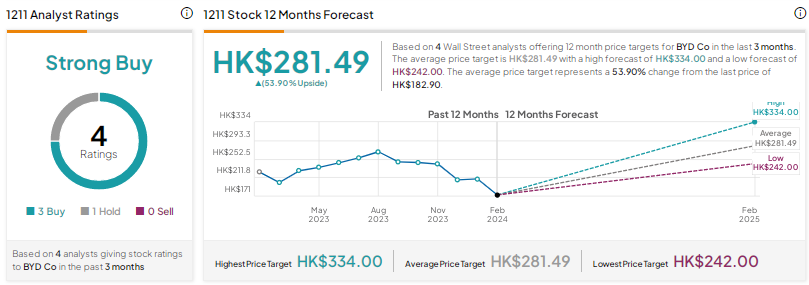

With three Buys and one Hold, 1211 stock earns a Strong Buy consensus rating. The BYD share price target of HK$281.49 implies nearly 54% upside potential.

Conclusion

BYD shares are in the red due to concerns about the macro situation in China. That said, analysts are upbeat about the company’s growth potential due to its upcoming new models, efforts to improve profitability, and expansion in key growth markets like Europe.