FTSE 100-listed retail company Burberry Group PLC’s (GB:BRBY) share price fell by around 10% during the early trading hours on Thursday. The sudden drop was fueled after the company reported its half-year earnings for 2023 today and issued a cautionary note on profit expectations for the full year.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Burberry became the latest fashion brand to signal a worldwide decline in luxury demand and stated that it might not achieve its annual revenue forecast of low double-digit growth. The company now expects its annual adjusted operating profit to fall in the “lower end” of the consensus range of £552 million to £668 million.

At the time of writing, the stock was trading down by 8.74%.

With a profound British heritage, Burberry Group is a global luxury brand. The company designs and sells clothing, footwear, and accessories in multiple markets.

Interim Results 2023 Snapshot

The revenue for the first half grew by 4% to £1.4 billion as compared to the £1.34 billion reported last year. Comparable store sales increased by 1% in the second quarter, mainly driven by a 10% growth in the EMEA region but offset by a 10% decline in the Americas. Among its product categories, outerwear comparable store sales increased by 21% in the first half, while leather goods jumped by 8% during the same period.

The reported operating profit fell by 15% to £223 million. The company attributed the overall slowdown to inflationary pressures on its customers.

The company also announced an interim dividend of 18.3p per share, which is 11% higher than the interim payment of 16.5p in 2022.

What is the Stock Price Forecast for Burberry?

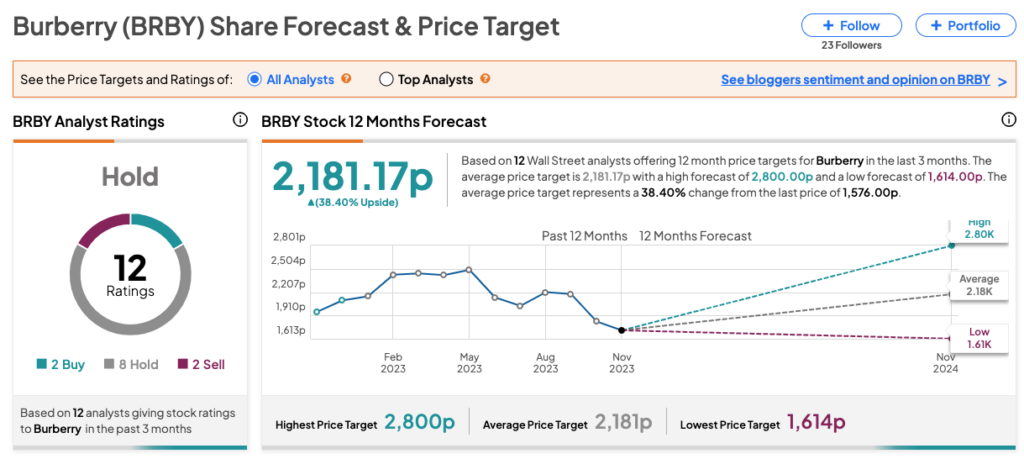

BRBY stock has received a Hold rating on TipRanks, backed by a total of 12 recommendations from analysts. It includes two Buy, eight Hold, and two sell ratings. The Burberry share price target is 2,181.17p, which is 39% higher than the current trading level.