British telecommunications giant BT Group (GB:BT.A) is reportedly testing the broadband services of American billionaire Elon Musk’s Starlink. BT Group aims to leverage Starlink’s satellite to reach the remotest part of the U.K., where telecom services are either nil or negligible.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

London-based BT Group is the largest provider of fixed-line, broadband, and mobile services in the U.K.It also provides subscription television and IT services. BT.A shares have lost 10.7% in the past year.

Links Between BT and Starlink

BT is testing Starlink’s satellite equipment at its Adastral Park research centre near Ipswich to see how it can reach the “rural non-spots” across Britain. Further, BT is testing how the satellite could improve its existing mobile signals. Starlink has roughly 5,000 satellites, based 350 miles above the earth, which beam down signals to households and businesses across the globe. The duo’s first successful satellite testing was conducted recently, where text messages were sent and received with unmodified smartphones.

BT currently uses the services of London-based OneWeb, with which it partnered in 2021. OneWeb provides high-speed, low-latency internet services to remote areas. A partnership between BT and Starlink would imply more competition for OneWeb and could also result in the end of its agreement with the telecom giant.

Meanwhile, sources said that Starlink has been pushing BT to sell its terminals to customers. However, BT is more interested in using Starlink satellite to improve its connectivity and reach under the universal service obligation. No definite deal between the two companies is in place yet, and BT may have to secure regulatory approval from London’s Ofcom before signing a deal.

What is the Price Target for BT Group?

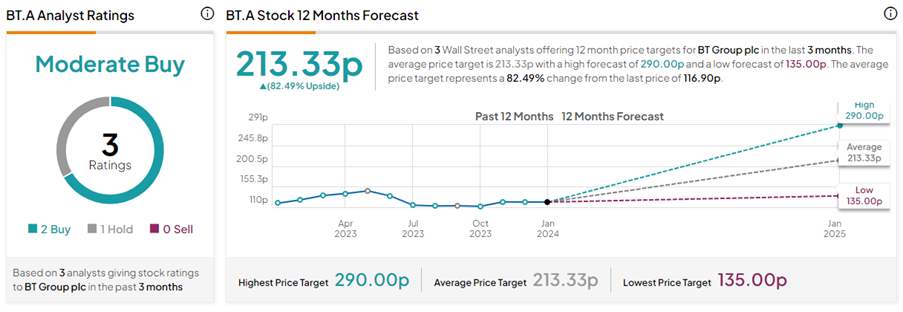

On TipRanks, BT.A stock has a Moderate Buy consensus rating based on two Buys and one Hold rating. The BT Group PLC share price target of 213.33p implies 82.5% upside potential from current levels.