UK-based BT Group (GB:BT.A) and Tullow Oil (GB:TLW) have Moderate Buy ratings from analysts on TipRanks. Analysts forecast that the stock prices of these two companies will experience a growth rate of over 50% in the upcoming year.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Let’s examine the details.

BT Group PLC

BT Group is the largest telecommunications company in the UK with a strong global presence. The stock started the year on a strong note but again fell by 8.3% in the last three months. It has experienced similar gains in the past two years, only to decline subsequently.

The company has a huge pile of debt, and revenue growth is expected to remain flat this year. Telecommunications companies face the need for substantial capital expenditures to remain competitive, and dealing with high levels of debt appears to be an inevitable consequence. However, investors like the stock for its dividends, which are attractive at a yield of 5.87%. Analysts anticipate that BT Group’s dividend growth will remain steady and unaffected in the upcoming years.

Five days ago, Robert Grindle from Deutsche Bank confirmed his Hold rating on the stock, suggesting a 13% upside in the share price. Grindle said, “BT is operating the right strategy despite a number of headwinds.”

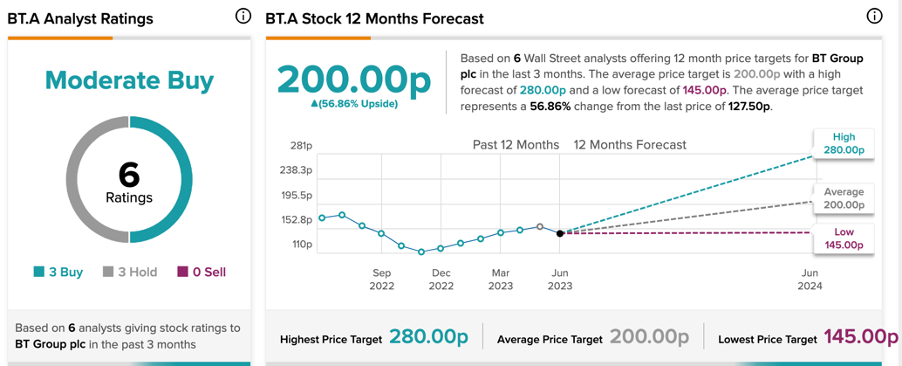

Is BT Group a Buy, Sell, or Hold?

According to TipRanks, the BT.A stock has a Moderate Buy rating, which is based on three Buy and three Hold recommendations. The average price forecast is 200p, implying a growth of 57% on the current trading levels.

Tullow Oil PLC

Tullow Oil is an energy company engaged in the exploration of oil and natural gas. The company has operations in Africa and South America. The company’s share price has struggled since the huge fall of 2019. In the last year, the stock has declined by 42%.

In its annual earnings for 2022, the company mentioned its three key focus areas as developing its exploration activities for its diversified pool of resources, maintaining sound financial health through cost and capital management, and delivering operational efficiency. For the year 2023, Tullow has set its guidance in the range of 58,000 to 64,000 barrels of oil equivalent per day and has projected the generation of approximately $900 million in operating cash flow.

Five days ago, Barclays’ analyst James Hosie expressed his bullishness on the stock, forecasting a growth rate of almost 90%. Barclays expects the company to post better progress in 2023, along with an improvement in its balance sheet.

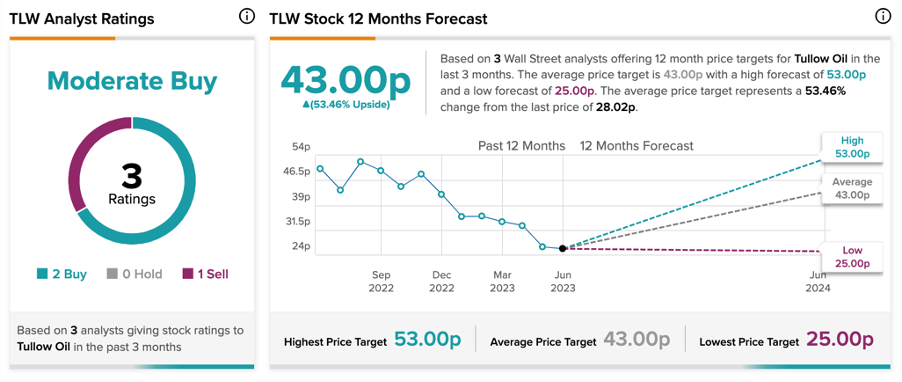

Is Tullow Oil a Good Buy?

Based on two Buy and one Sell recommendations, TLW stock has a Moderate Buy rating on TipRanks.

The average price forecast is 43.0p, which is 53% above the current trading level.

Conclusion

Both BT Group and Tullow Oil have endured a challenging period marked by declining share prices in recent years. However, looking ahead, analysts are optimistic, projecting a potential increase of over 50% in their share prices.

Given these factors, these UK stocks have the potential to be valuable additions to investors’ portfolios.