Telecom giant BT Group (GB:BT.A) and beverage manufacturer Diageo (GB:DGE) will release their earnings in the coming days.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

As an investor, it is equally important to keep track of your investments. After investing in a stock, there are three major questions: what’s happening in the company, how is it performing, and what is the outlook? And what’s better than the earnings report to answer these questions?

In this situation, the TipRanks Earnings Calendar is a perfect way to check the earnings dates of the companies in any particular market. This tool lists date-wise earnings schedules of companies, which can be filtered based on sectors, analyst ratings, market cap, etc.

Let’s have a look at what analysts are saying about these companies.

BT Group Plc

The BT Group is a UK-based telecommunications company that operates in fixed-line, broadband, and mobile services.

BT Group will report its Q3 earnings for the fiscal year 2023 on February 2, 2023. The stock has started the year on a positive note and has almost gained 15% since the beginning of January 2023. Overall, the stock has been trading down by 27% in the last year.

The downturn was mainly due to the company’s higher costs, which impacted its earnings in 2022. The company’s free cash flow was also hit because of heavy investments in the networks. Since then, the company has raised its wholesale prices for the internet and has also increased the prices for broadband customers based on inflation.

The analysts are bullish on the Q3 earnings, as they look forward to seeing how the price hike has improved the company’s margins. The analysts expect earnings of 0.05p per share in Q3, which is the same as what the company posted in Q3 of 2022. Even though top-line growth will decline, a 3% growth in earnings (EBITDA) is expected.

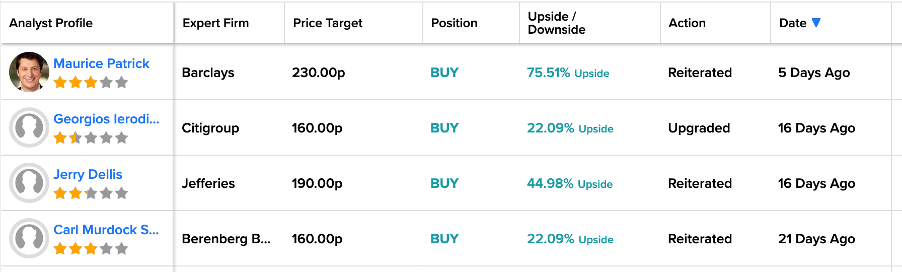

Recently, major investment banks have reiterated their Buy ratings on the stock ahead of earnings. Maurice Patrick from Barclays has one of the highest target prices on the stock, which has an upside of 75.5%. Citigroup analyst Georgios Ierodiaconou has upgraded his rating from Hold to Buy on the stock. Citigroup commented that “pricing momentum could offset free cash flow headwinds.”

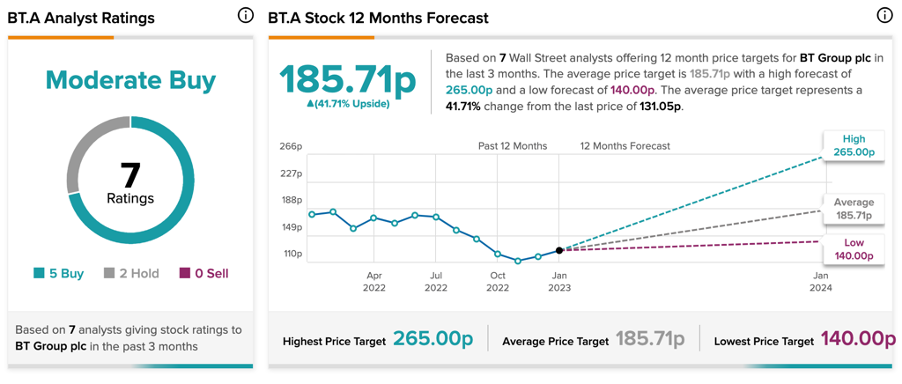

BT Group Share Price Forecast

BT Group’s average share price forecast is 185.71p, which has an upside of 41.7%.

Overall, the stock has a total of seven ratings on TipRanks with a consensus of Moderate Buy.

Diageo Plc

Diageo is a leading manufacturer and distributor of alcoholic beverages, with sales in more than 180 countries. The company owns a portfolio of 200 brands, including Baileys, Johnnie Walker, Guinness, Smirnoff, etc.

Diageo will release its first-half results for the fiscal year 2023 on January 26, 2023. The consensus earnings forecast for the second quarter is 1.03p per share, as compared to 0.85p in the same quarter a year ago.

The company’s brand power and its global operations give it an edge over the competition in terms of pricing and diversification. This will help drive top-line growth. For the first half, the analysts expect the revenues to grow by 21.4%. Other positive factors impacting the results would be a recovery in demand in the key markets, improved travel retail demand, and the performance of its premium brands.

On the flip side, the company is facing pressure on its profits due to higher inflation costs and supply disruptions, which will be seen in the results as well.

Analysts have mixed opinions on the stock ahead of its earnings. Celine Pannuti from J.P. Morgan recently reiterated her Buy rating on the stock.

Deutsche Bank has confirmed its Sell rating on the stock and reduced the target price from 3,160p to 2,750p. It believes a “downtrading” trend in the industry along with “cost pressures” will impact the interim results.

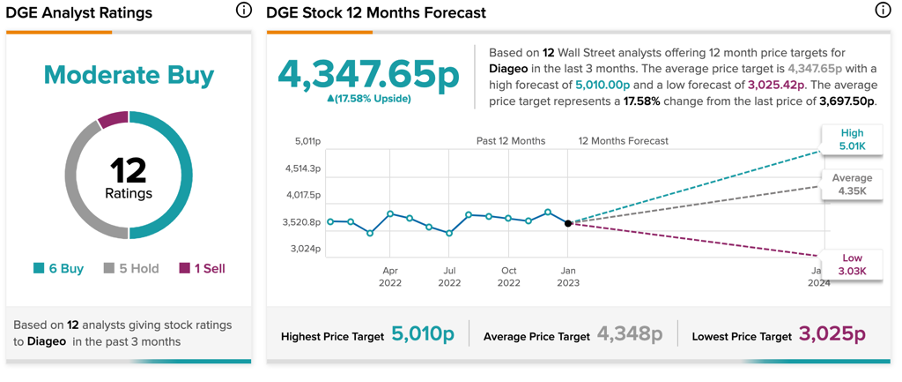

Is Diageo a Buy or Sell?

Diageo’s stock has been trading up by 2.7% in the last year.

According to TipRanks’ analyst consensus, Diageo stock has a Moderate Buy rating, based on six Buy, five Hold, and 1 Sell recommendations.

The DGE target price is 4,347.65p, which is 18% higher than the current price level.

Conclusion

Both BT Group and Diageo are well-known brands in the UK and are always on the radar of analysts and investors. Analysts are highly bullish on BT Group’s results, while Diageo has mixed reviews for its earnings.