ASX-listed companies Beach Energy Limited (AU:BPT) and IGO Ltd. (AU:IGO) have received Moderate Buy ratings from analysts. Analysts anticipate that BPT has a greater potential for an increase in its share price, with a projected upside of over 30%, whereas IGO is expected to experience approximately 15% growth.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Let’s take a closer look at them.

Beach Energy Limited

Beach Energy is the biggest onshore oil producer in Australia, accompanied by a significant gas business. The company has operations in South Australia, Victoria, Western Australia, Queensland, and New Zealand.

Due to the volatility in energy prices, the company’s stock has also followed a similar pattern and has been trading down by 12.2% in the last year. The company also reported a 3% fall in profits in its half-yearly earnings released in February. This was mainly due to higher financing costs, which led to lower gross profits.

However, the company doubled its dividend payout to AU$0.02 per share as compared to the previous year. The company’s revised strategy involves aiming for a dividend payout ratio of 40-50% of pre-growth free cash flow, which would allow shareholders to receive franking credits.

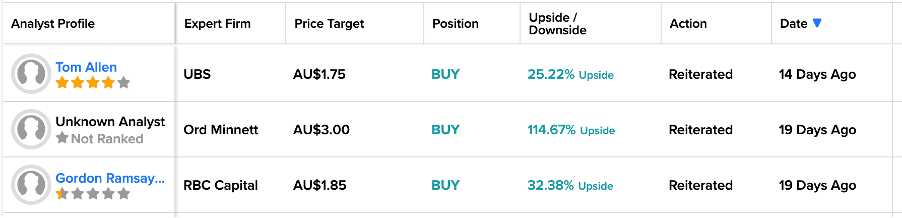

Moving on to analysts’ views, there has been a notable surge in positive sentiment surrounding the stock within the past month. 19 days ago, Australian wealth management company Ord Minnett reiterated their Buy rating on the stock at the highest price target of AU$3.0. This implies a growth rate of more than 100% in the share price.

14 days ago, UBS analyst Tom Allen also reconfirmed his Buy rating and predicted an upside of 25% in the share price.

Is Beach Energy a Good Investment?

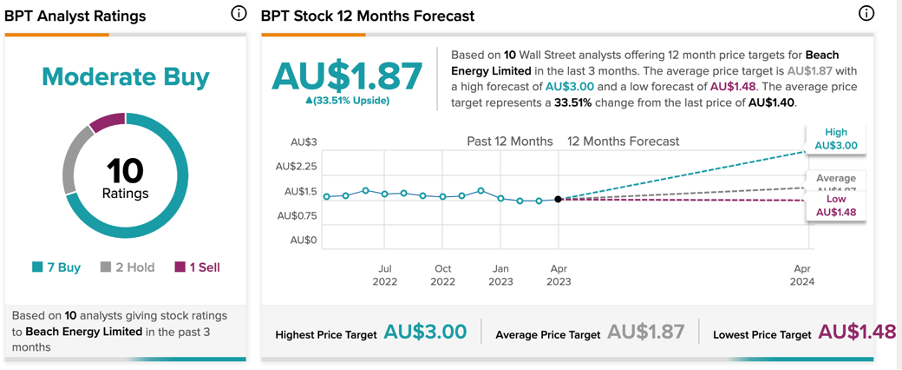

BPT stock has a Moderate Buy rating on TipRanks based on seven Buy, two Hold, and one Sell recommendations.

The average price target is AU$1.87, which shows a growth of 33.5% on the current price level.

IGO Limited

IGO is an Australian mining company with a strong dedication to exploring and identifying future resources and is committed to investing in exploration activities to ensure a consistent supply of clean energy metals for the world’s sustainability.

The company has also invested in a lithium-focused joint venture with Tianqi Lithium Corporation with the aim of developing top-class lithium assets. Analysts remain bullish on the stock considering the longer-term positive outlook for lithium.

According to UBS, there is short-term volatility expected for lithium stocks. However, over the long term, the market is expected to grow by eight times. UBS analyst Levi Spry has a Buy rating on IGO and expects a growth of 36% in the share price.

Similarly, Citigroup is also bullish on the stock, and analyst Kate McCutcheon reiterated her Buy rating two days ago. She predicts an upside of 22.09% from the current level. Citi’s long-term view for higher lithium prices is based on the commodity’s significant exposure to the worldwide expansion of electric vehicles (EVs), particularly in China.

What is the Future Price Target of IGO?

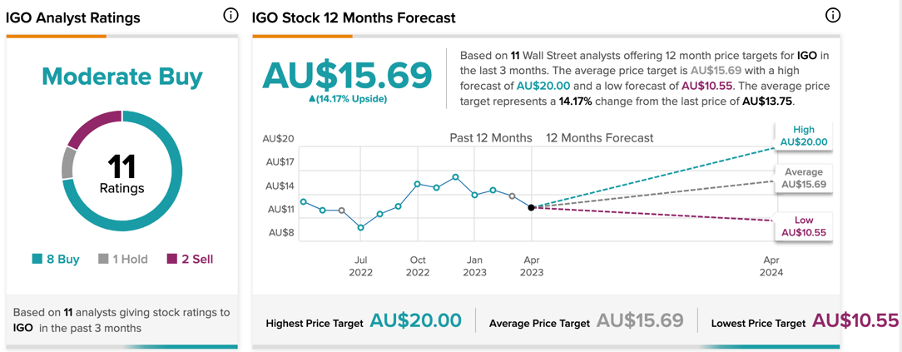

According to TipRanks’ analyst consensus, IGO stock has a Moderate Buy rating. The stock has a total of 11 recommendations, of which eight are Buy.

The average price target is AU$15.69, which is 14.17% higher than the current price level.

Ending Notes

Investors frequently depend on analyst recommendations when making decisions about stock investments. Analysts are bullish on these two Australian stocks, but they anticipate Beach Energy to have a higher potential for growth over the next year.