The FTSE 100-listed BP PLC (GB:BP) yesterday announced that it has halted all its oil shipments through the Red Sea following the attacks by Houthi militants from Yemen. The company joined the list of several shipping giants who are avoiding this route for any trade to prioritize the safety of workers.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Following the announcement, Brent crude, the global benchmark, surged around 1.5% to reach $78.09 per barrel yesterday. Analysts remain cautious about the volatility in oil prices, as the situation could potentially challenge global supply chains and raise costs on a larger scale. Additionally, oil prices could rise further if more energy companies announce trade disruptions.

The BP share price traded up by 1.7% in yesterday’s trading session.

Rising Security Concerns

The Suez Canal, a vital waterway linking the Red Sea to the Mediterranean Sea, is the most direct shipping route between Europe and Asia. This route navigates around 15% of the global shipping traffic. Since the outbreak of the Israel-Hamas war, there have been multiple attacks by Houthi rebels, claiming these to be acts of revenge against Israel.

The growing security concerns in the region will further disrupt the oil movement from Saudi Arabia and Iraq to Europe and other regions.

In the wake of BP’s announcement, the U.S. declared its intention to spearhead an international naval operation to safeguard ships along the route.

Is BP a Good Stock to Buy Now?

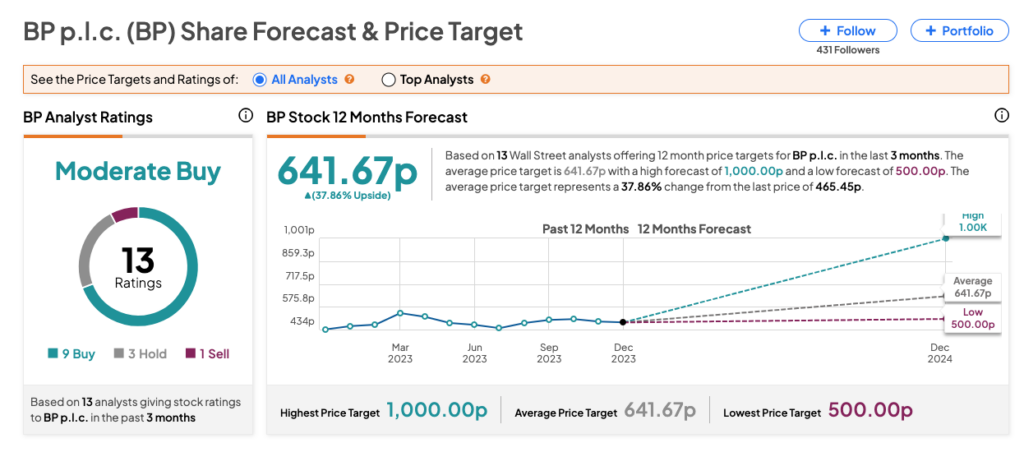

According to TipRanks, BP stock has been assigned a Moderate Buy consensus rating. The stock has nine Buys, three Holds, and one Sell recommendation. The BP share price forecast is 641.67p, which is almost 38% higher than the current price level.