Energy companies BP PLC (GB:BP) and Equinor ASA (NYSE:EQNR) have scrapped the deal for the Empire Wind 2 project with NYSERDA (New York State Energy Research and Development Authority). The Empire Wind 2 project included an offshore wind farm in the U.S. with a power generation capacity of 1,260 MW (megawatts).

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The BP share price traded up by 0.31% in yesterday’s trading session. Equinor ended the day with a gain of 2.06%.

Empire Offshore Wind is a 50-50 joint venture between Equinor, a Norway-based energy company, and BP. The project comprises two phases, Empire Wind 1 and 2, with a combined potential capacity exceeding 2 GW (gigawatts).

What Led to the Cancellation of the Deal?

The decision was attributed to changes in the overall economic conditions across the industry. The move was based on many factors, including rising inflation, interest rates leading to higher borrowing costs, and supply chain disruptions. All these factors impacted the commercial viability of the project.

With this move, both companies have cancelled existing contracts and submitted new proposals for projects at higher prices. The companies are expected to announce their new names in February.

On the Losing Side

Singapore-based Seatrium Ltd. (formerly known as Sembcorp Marine Ltd.) (SG:S51) has lost a wind farm contract for around S$250 million as part of this deal. The terminated contract was originally part of a S$500 million agreement signed in May 2023 to develop platforms for both offshore wind farms, Empire Wind 1 and 2.

The company stated that work on the Empire Wind 1 project has already begun and “remains unaffected” by this development. It further emphasized that this cancellation is not anticipated to have a significant financial impact on the company’s FY23 numbers.

According to DBS Group Research, the contract’s value is relatively minor, which makes for less than “1.5% of the company’s orderbook.” Today, analyst Pei Hwa Ho from DBS confirmed his Buy rating on Seatrium, predicting a 50% upside in the share price.

Is BP a Good Share to Buy?

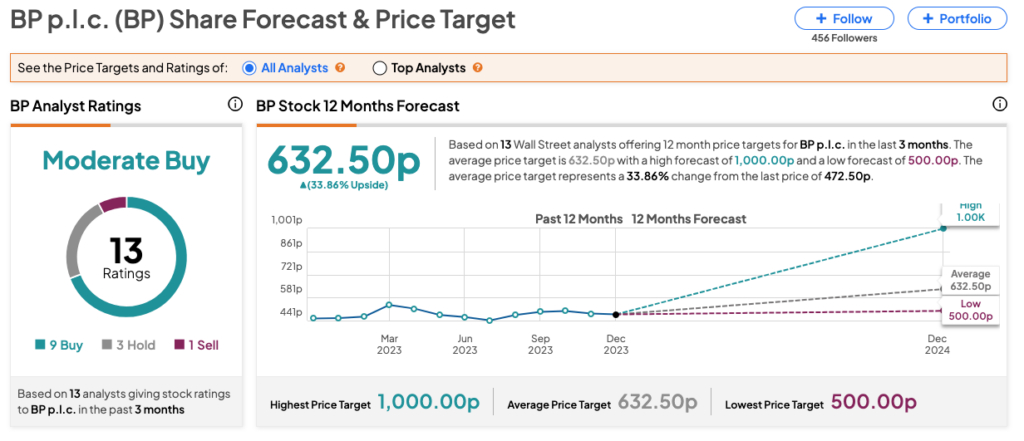

According to TipRanks’ analysts’ consensus, BP stock has been assigned a Moderate Buy rating. The stock has nine Buys, three Holds, and one Sell recommendation from analysts. The BP share price forecast is 632.5p, which is 34% higher than the current price level.