The FTSE 100 constituent BP PLC (BP, GB:BP) announced yesterday the unexpected departure of its CEO, Bernard Looney, for not being “fully transparent” in disclosing his past relationships with colleagues. Looney resigned with immediate effect. The company’s current CFO, Murray Auchincloss, has assumed the role of interim CEO.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Looney joined the energy group in 1991 and dedicated his entire career to BP. He was appointed as the CEO of the company in 2020, during a challenging period marked by the pandemic. Looney made an impactful impression in his four years as BP’s head, leading the company towards higher profits and dividends. Moreover, he guided the company through the ongoing transition towards cleaner energy sources.

The U.K.-listed shares of BP were up 0.84% on Tuesday. However, the stock trended lower this morning.

BP PLC is a well-known name in the energy sector, which produces oil, natural gas, and petroleum products. Headquartered in London, the company boasts a global presence spanning nearly all continents.

What Led to the CEO’s Resignation?

The company stated that it received and examined the allegations made by an anonymous source in May 2022, relating to Looney’s conduct concerning his personal relationships with company colleagues. During this investigation, Looney revealed a limited number of his previous relationships that existed before his tenure as the CEO. The inquiry did not reveal any misconduct. However, recently, the company again started the investigation, during which Looney accepted that he did not disclose all of his previous relationships and was not “fully transparent.”

Nevertheless, BP opted to maintain secrecy regarding the precise nature of these allegations. It also stated that any compensation to Looney is yet to be decided.

Is BP PLC a Good Stock to Buy?

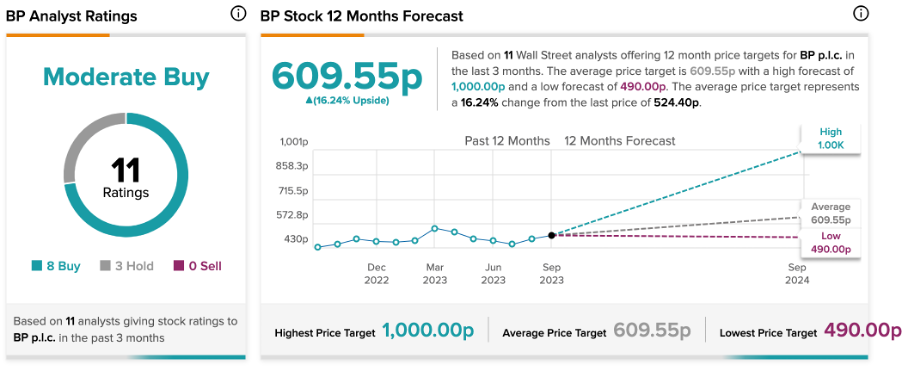

Post-announcement, analyst Lydia Rainforth from Barclays reiterated her Buy rating on the stock, predicting more than 90% upside in the share price.

According to TipRanks’ analyst consensus, BP stock has received a Moderate Buy rating backed by a total of 11 recommendations, of which eight are Buy. The BP share price forecast is 609.5p, which is 16.2% higher than the current price level.