British American Tobacco (GB:BATS) and BP Plc (GB:BP) from the FTSE 100 are going to report their final quarter earnings for 2022 over the next 10 days. Both of these companies are large-cap stocks and are famous among investors for their stable earnings.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Analysts see a big upside in the share prices of these stocks and have maintained their Buy ratings, ahead of the earnings.

Here, we have used the TipRanks Earnings Calendar for the UK market to list the upcoming events. Using this tool, investors can stay up-to-date during the earnings season. This tool provides a list of companies that are about to report their earnings and can be filtered on various factors, like sector, analyst rating, market cap, etc.

Let’s have a look at the details.

British American Tobacco Plc (BAT)

BAT is a global cigarette manufacturing company with brands like Camel, Dunhill, Kent, Newport, etc. The company has a presence on six continents and sells its products in over 175 markets.

The company’s stock is off to a dull start, and it is already trading down by more than 10% since the beginning of 2023. However, the analyst feels the falling share price presents a buying opportunity to investors. Analysts are positive on the dividend yield of 7.17%, an expected buyback in 2023, and a recovery in sales volume.

The company will report its Q4 and full-year results for 2022 on February 9, 2023. The analysts forecast a quarterly EPS of 2.03p per share, against an EPS of 1.75p in the same quarter a year ago. For the full year, the company expects single-digit EPS growth. The company remains confident in its new category business, which is performing well in terms of volumes and market share.

Jefferies recently reiterated its buy rating on the stock ahead of earnings, predicting a 55% increase in share price. Analyst Owen Bennett feels the earnings and top line might disappoint, but they will fully recover in 2023 and beyond. Bennett expects a 2.6% growth in sales, while the company expects revenue growth of 2-4% for 2022.

British American Tobacco Stock Forecast

According to TipRanks’ analyst consensus, BATS’ stock has a Strong Buy rating.

The BATS target price is 4,044.4p, which is 33.2% higher than the current price level. The price has a high forecast of 4,700p and a low forecast of 3,800p.

BP Plc

BP is a leading energy company in the UK, with a huge supplier network spread across 60 countries.

The company will report fourth-quarter earnings for 2022 on February 7, 2023. The consensus EPS forecast is 0.22p per share, which is higher than the 0.21p reported in Q4 of 2021. Even though oil prices have been falling since reaching highs in 2022, this quarter’s earnings will not be impacted by the decline in prices. The revenue estimate for the quarter is $60.85 billion.

For the third quarter of 2022, the company posted underlying earnings of $8.2 billion, which exceeded analyst estimates of $6.1 billion. Following this, the company announced a $2.5 billion share buyback in Q4.

Moving forward, analysts remain bullish on the stock and have reiterated their Buy rating on the stock.

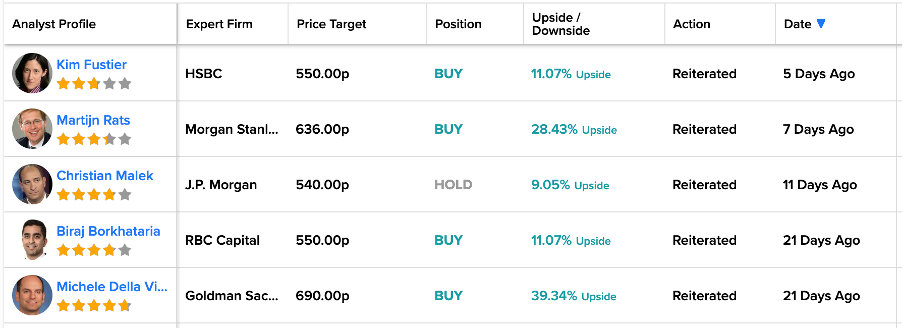

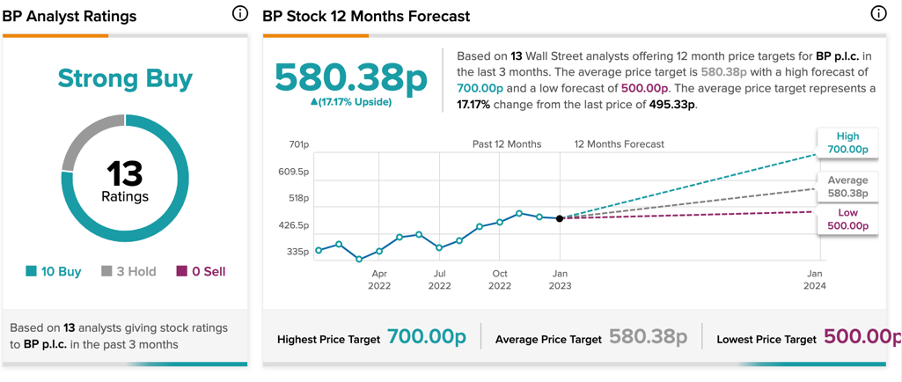

What is the Target Price for BP?

BP’s stock target price is 580.4p, which has an upside of 17.16% from the current level.

According to TipRanks’ consensus, the stock has a Strong Buy rating, with 10 Buy recommendations.

Conclusion

Analysts expect the new category business, a dividend yield, and a share buyback to drive full-year earnings for BAT.

On the other hand, analysts feel BP will witness another record earnings year in 2022, driven by higher oil prices.