The French banking group BNP Paribas SA (FR:BNP) yesterday announced the settlement of its dispute with its customers over home loan currency risks. The court found the bank guilty of misleading its customers into acquiring high-risk mortgages in Swiss francs.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The settlement agreement was signed between the country’s consumer group CLCV and the bank’s personal finance unit for around 4,400 contracts that were entered into during the 2008-2009 financial crisis. As part of the settlement, the bank will pay up to €600 million. The BNP Paribas share price is trading down by 0.73% today at the time of writing.

Based in France, BNP is a diversified financial group providing a wide range of retail, corporate, and institutional banking services.

The Backdrop

The mortgage loan, known as Helvet Immo, was offered by one of the subsidiaries of BNP Paribas. These loans were issued in Swiss francs and were repayable in euros. The loan terms allowed borrowers to take advantage of lower interest rates but also exposed them to the risk of foreign exchange fluctuations, which was adequately communicated to them.

As a result, customers were adversely affected when the franc surged against the euro during the eurozone’s debt crisis in 2010, leading to monthly inflated payments.

The final decision came after eight years of legal proceedings initiated by the CLCV.

What is the Target Price for BNP Paribas?

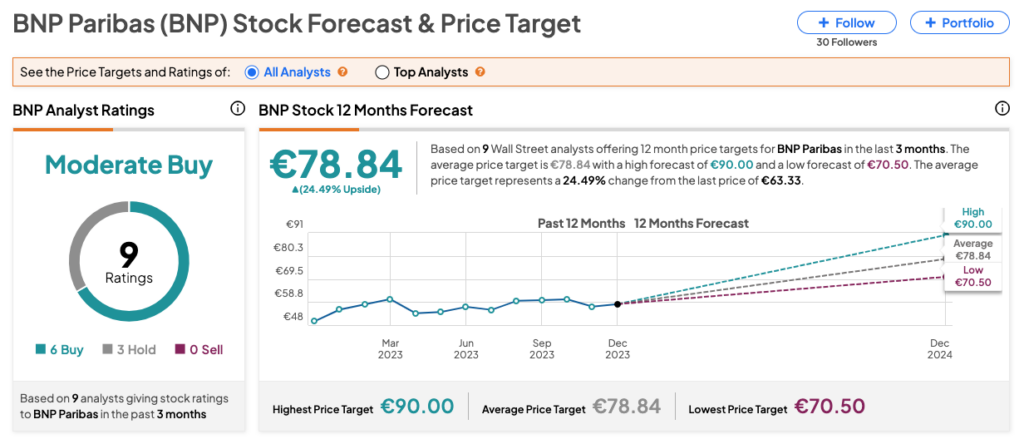

According to TipRanks consensus, BNP stock has received a Moderate Buy consensus rating based on six Buy and three Hold recommendations. The average BNP share price target is €78.84, which is nearly 25% above the current trading level.