German carmaker Bayerische Motoren Werke Aktiengesellschaft (BMW) (DE:BMW) has big dreams for electric vehicles (EVs) despite signs that demand is cooling. In a Bloomberg interview on Wednesday, BMW North America’s CEO Sebastian Mackensen acknowledged that the EV market in the U.S. is growing, albeit at a slower pace. The demand for EVs is not increasing the way experts had initially projected, he added.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Talking about BMW’s EV ambitions, Mackensen said that the company plans to build six EV models in the Spartanburg plant, South Carolina, by 2030. To amp up demand, BMW plans to offer lease credits to retail customers, thus leveraging the Federal EV subsidies to make EVs more affordable. Mackensen clearly stated that customers are unwilling to pay a “real price premium” for EVs compared to ICE (internal combustion engine) models.

To support its EV plans, the automaker has started constructing a high-voltage battery assembly plant in Woodruff, South Carolina. BMW has spent $700 million in setting up this plant. Speaking of competition, Mackensen did acknowledge rival Tesla (NASDAQ:TSLA) as the leader in the EV industry. He sees the demand for Tesla’s EVs as a sign of relevant demand for EVs in general.

BMW’s Autonomous Driving Plans Take Shape

In a separate update, BMW has been granted a test license for level 3 (L3) autonomous driving in Shanghai. Through this license, BMW can test advanced autonomous driving features in expanded areas across Shanghai. In 2018, it was allowed to test such autos within a 5.6 km (3.5 miles) radius of public roads in the city.

The move brings BMW one step closer to its dream of operating driverless cars in the high-speed streets of China. The next step for BMW will be to operate cars with L3 self-driving technology in Shanghai once it receives approval from Chinese authorities.

Is BMW a Buy or Sell Stock?

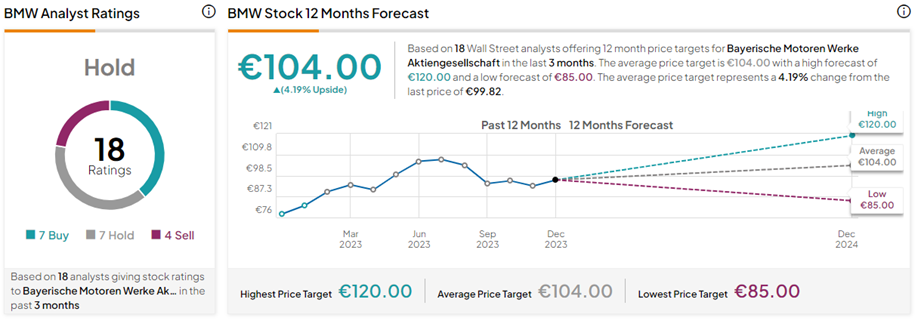

On TipRanks, BMW stock has a Hold consensus rating based on seven Buys, seven Holds, and four Sell ratings. The BMW share price target of €104.00 implies 4.2% upside potential from current levels. Year-to-date, BMW stock has gained 26.2%.