Germany is on a challenging journey to become a market leader in electric vehicles. The country is targeting around 6 million elective vehicles on its roads by 2030. This paradigm shift has also attracted the attention of investors and analysts to German automotive companies.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

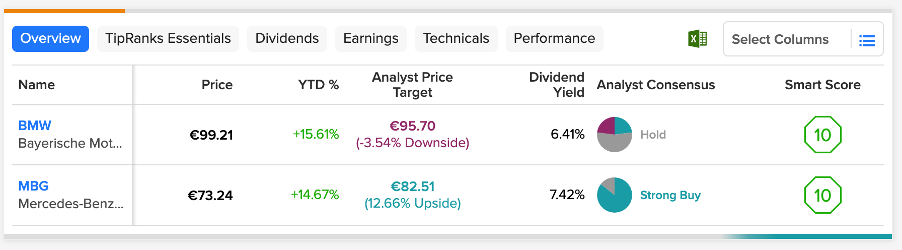

Here, we have used the TipRanks’ Stock Comparison tool in the German market to analyze Bayerische Motoren Werke Aktiengesellschaft (DE:BMW) and Mercedes-Benz Group (DE:MBG) against each other.

Bayerische Motoren Werke Aktiengesellschaft (BMW)

BMW is among the leading manufacturers of premium automobiles in the world, with brands like BMW, Rolls-Royce, MINI, etc. in its portfolio.

In the Q3 results for 2022, BMW posted a 20% increase in its profits of €4.1 billion. The company’s deliveries remain flat, but its share of EVs has increased to 16.8% from 13.2%. During this time, BMW and MINI electric model deliveries increased by 150% and 45.2%, respectively, while total EV and hybrid model deliveries increased by 22.3%.

In the EV battlespace, BMW is at the forefront, trying to grab a higher market share. The company is targeting 50% of its total global sales to come from EVs by 2030. The company has been able to handle the global supply chain issues in a better way, and further recovery is expected in its fourth quarter of 2022.

The company will invest €30 billion to enhance its EV market by 2025.

Will BMW Stock Go Up?

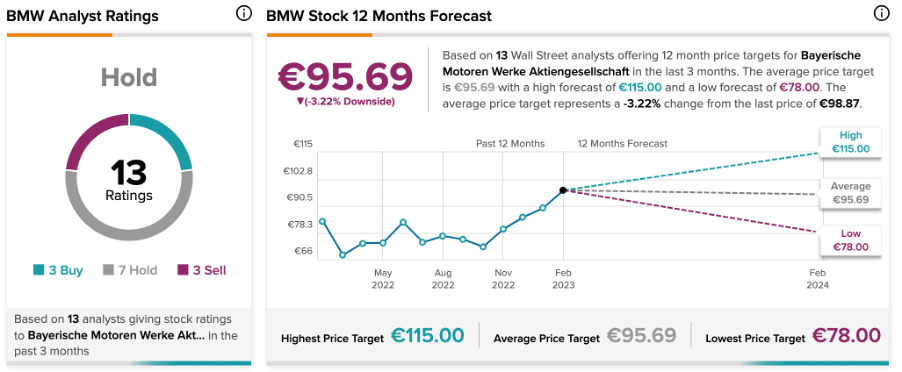

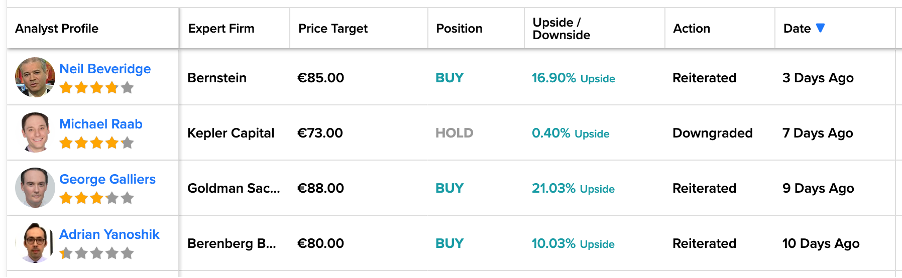

Talking about the share price, BMW stock has mixed opinions from analysts. BMW stock gained around 77% in the last three years, with a 25% increase in the last three months. Overall, the analysts’ consensus for the target price is €95.69, which is 3.19% lower than the current trading price.

According to TipRanks’ rating consensus, BMW stock has a Hold rating.

Mercedes-Benz Group

Another player from the German market, Mercedes-Benz, is also marking its space in the EV market. The company announced that it would invest €40 billion towards its plan to boost its EV production and aim to shift to all-electric by 2030.

Mercedes posted solid growth of 83% in its earnings of €5.2 billion in its third-quarter results for 2022. The company’s revenues increased by 19% to €37.7 billion, with its BEV (battery electric vehicles) sales witnessing a huge jump of 183% in the quarter. The company expects its Q4 sales to be slightly ahead of the previous quarter’s numbers. However, overall vehicle deliveries were down by 1% in 2022 as compared to 2021.

The company remains positive in its top-end category, which contributes 15% to its total sales.

Is Mercedes Stock a Buy?

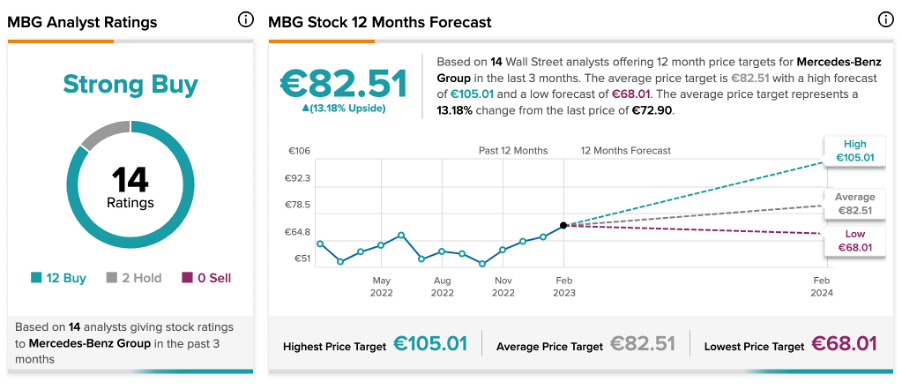

After its Q3 earnings, the company’s stock gained almost 20% in the last three months. As per the TipRanks database, the Mercedes stock has a Strong Buy rating with 12 Buy recommendations.

Neil Beveridge from Bernstein recently reiterated his Buy rating on the stock at a target price of €85, which has an upside of 16.5%.

The analysts expect a 13% increase in MBG stock prices, with an average price target of €82.51. The high and low forecasts for the price are €105 and €68, respectively.

Conclusion

Despite a difficult year for EVs in 2022, the companies are expected to finish the fourth quarter with higher sales numbers. The overall outlook for the EV industry is positive in 2023, and it remains a bright spot for these automobile companies. The ongoing supply issues and bottlenecks have started to ease out, but they will continue to keep the production volatile.

Among these two players, analysts are more bullish on Mercedes stock, with more upside expected in its share price.