Shares of ASX-listed BlueBet Holdings Ltd (AU:BBT) skyrocketed over 30% this morning as potential merger talks with rival betr emerged. Michael Sullivan’s BlueBet and Matthew Tripp-led betr are having merger talks, several reports suggested. The negotiations are in initial stages and no deal has been finalized yet, implying that talks could fall apart.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

The Australian sports betting market is heavily regulated. Online bookies are expecting a slew of tougher regulations, including a ban on gambling advertising and increased point-of-consumption taxes. The ban could affect the popularity of players while also stripping off a revenue source. Moreover, macro headwinds are already dragging down consumer spending on online betting, thus impacting the companies’ profits.

More About the Two Companies and the Merger Benefits

BlueBet Holdings is an Australian online bookmaker offering a range of sports betting and racing products, including fixed odds betting, live betting, and exotic betting. Its main product lines include sports, horse racing, greyhound racing, harness racing, and on-track bets. Since its initial public listing in 2021, BBT shares have lost nearly 89%.

Meanwhile, privately owned betr is an Australian online gaming and sports betting company. Launched in 2022, betr initially had the backing of News Corp Australia and Tekkorp. However, the company has had a rough patch lately, with both its initial backers exiting their stakes amid a slowdown in the sports betting sector.

A merger of the two well-known companies could expand their scale and drive higher revenues. BlueBet is said to have a 2% market share of the Australian online sports betting sector. Its revenues hit A$536.6 million in Fiscal 2023. At the same time, betr boasts a larger revenue base of roughly A$2 billion in 2022. Earlier, there were speculations that betr would acquire BlueBet, but the latter has agreed that a merger would be a more suitable option considering shareholder value maximization. Doubts remain as to whether BlueBet will be delisted after the merger and go private or whether betr will be listed as part of the newly formed company.

Is BBT a Good Investment?

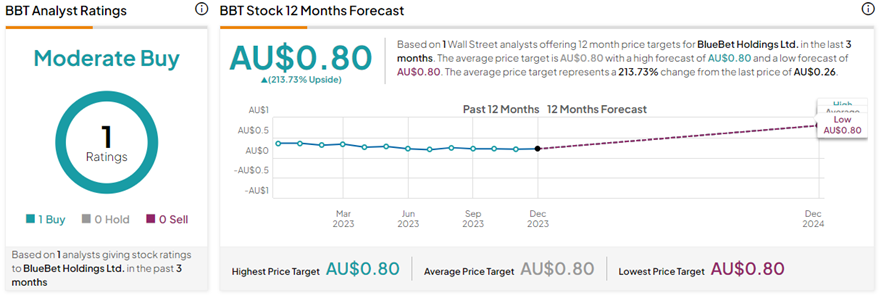

On TipRanks, BBT stock has a Moderate Buy consensus rating based on only one Buy rating received during the past three months. The BlueBet Holdings share price forecast of AU$0.80 implies a whopping 213.7% upside potential from current levels. BBT shares have lost 31.1% in the past month.