After delivering a growth rate of 35% in the last year, ASX-listed BHP Group Limited’s (AU:BHP) shares are headed for the downside. Based on analysts’ assessments, the stock has a Hold rating, and they predict a further decline in the share price. The shares have lost 7% in the last six months.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

BHP is a well-known mining company engaged in extracting and producing a wide range of commodities, including iron ore, coal, copper, nickel, and various other minerals.

Recently, the company’s stock received a lot of attention from analysts after it published its operational review for the year ended June 30, 2023.

BHP Trading Update

The company successfully achieved its full-year production guidance for copper, iron ore, metallurgical coal, and energy coal.

BHP also hit record numbers in iron ore production at 285.2 million metric tons. Iron ore remains the largest contributor to the company’s overall revenues. The numbers were mainly driven by improved production at its South Flank operations in Western Australia. The company is also suffering from higher costs and expects them to be at the higher end of the forecasted range.

In 2023, average realized prices for copper, iron ore, and metallurgical coal products were lower compared to the previous year. However, thermal coal prices were higher, especially in the first half. Nickel prices were steady throughout the year.

For the fiscal year 2024, the company forecasts Western Australia’s iron ore output to range between 282 million and 294 million metric tons.

Analysts’ Reaction

BHP’s stock enjoys wide coverage from analysts on TipRanks. Post-update, many analysts have reiterated their ratings on the stock.

Analysts from Ord Minnett confirmed their Hold rating on the stock today, predicting a downside of 12.5%.

While Dominic OKane from J.P. Morgan predicts a much higher downside of 45% in the share price. He reiterated his Sell rating on the stock today at a price target of AU$24.80.

Yesterday, Citigroup analyst Paul McTaggart also reiterated his Hold rating, with a modest decline of 2.5% in the share price. McTaggart also cut its fiscal year 2023 earnings forecast.

Citigroup forecasts core net profit to reach $13.62 billion for fiscal year 2023 and $11.95 billion for fiscal year 2024, a significant decline from the $21.03 billion recorded in FY22, primarily due to the impact of weak iron ore prices.

BHP Share Price Forecast

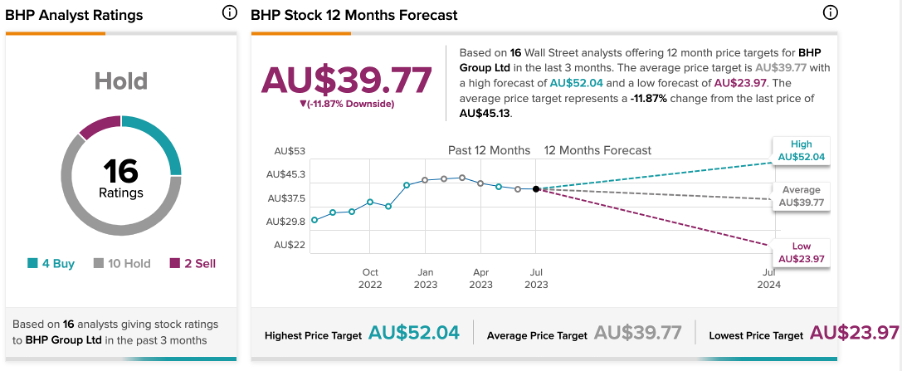

TipRanks rates BHP stock as a Hold with 16 total recommendations, including four Buy ratings.

The target price is AU$39.77, which is almost 12% lower than the current price level.

Conclusion

As a renowned mining company in Australia, the performance of the company’s share price is heavily impacted by the outlook for iron ore prices. At present, the outlook for iron ore is marked by volatility and frequent fluctuations, with changes happening on an almost daily basis.

Currently, the stock doesn’t offer any significant upside in its share price and has been rated as a Hold.