ASX-listed companies BHP Group Ltd. (AU:BHP) and Commonwealth Bank of Australia (AU:CBA) are known for paying consistent dividends. Even though their share price growth story is not that rosy, these companies remain committed to increasing their shareholders’ returns.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

With ever-growing inflation, volatility in financial markets, and the recent banking crisis, dividend-paying companies have become a safer bet for investors.

Let’s have a look at these companies in detail.

BHP Group Limited

BHP Group is a multinational resources company engaged in iron ore, coal, copper, nickel, and more.

The stock has generated more than 120% of returns over the last three years, driven by the company’s higher production numbers and high commodity prices.

In the last month, the stock has been trading down by 11%. The falling commodity prices and rising costs have impacted the company’s operations. In its first-half earnings for the fiscal year 2023, the company posted a decline of 16% in its revenues. BHP’s attributable profit was down 32% to $6.6 billion, mainly hit by iron ore and copper prices.

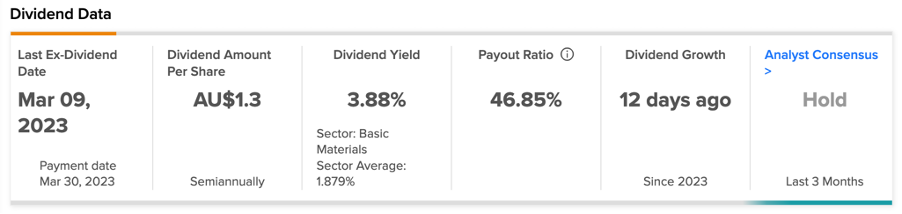

As a result of lower profits, the company slashed its interim dividend by 40% to $0.90 (AU$1.3) per share.

Even though the earnings and dividends were lower, they were not much of a surprise for shareholders. Moving forward, the company’s efforts to shift its focus toward commodities like copper and nickel will reduce its dependency on iron ore, which is important for its future growth.

Is BHP Stock a Good Buy?

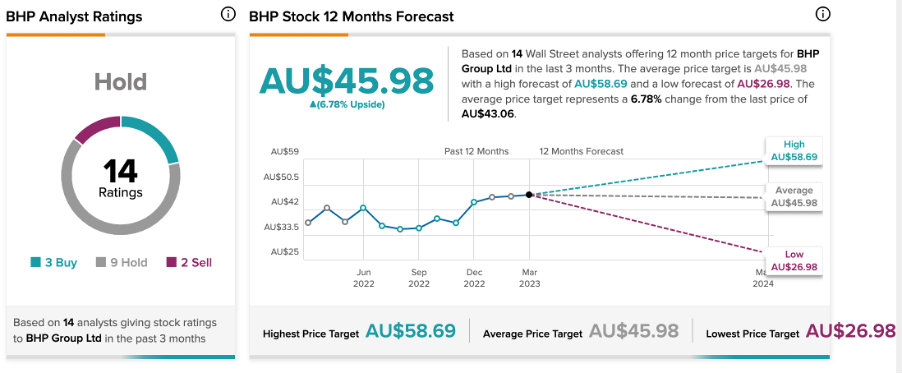

According to TipRanks, BHP stock has a Hold Buy rating based on a total of 14 recommendations.

The target price of AU$45.98 is 6.7% higher than the current price level.

Commonwealth Bank of Australia

CommBank provides a broad range of banking and financial services to its customers across Australia and other global locations.

Despite posting solid numbers in its half-yearly earnings for the fiscal year 2023, the bank’s stock has seen a pullback. The stock is down by more than 6% in the last three months. The bank posted a 10% increase in its statutory net profit of AU$5.2 billion, driven by higher net interest income.

In terms of dividends, the bank announced an interim dividend of AU$21.0 per share, which was 35% higher than the same period of the previous year. CommBank also launched a buyback for AU$1 billion in sync with its long-term capital management approach.

Looking at the bank’s CET1 ratio of 11.4%, the dividend picture for the future looks stable and growing.

CBA Share Price Forecast

CBA stock has a Moderate Sell rating on TipRanks, based on seven Sell and three Hold recommendations.

The target price is AU$91.88, which is 5.16% lower than the current price level.

Conclusion

According to analysts, these two ASX companies don’t have much upside in their share prices. However, their dividend picture stays consistent and could be a good option for income investors.