UK-based Berkeley Group PLC (GB:BKG) signalled challenges in the UK housing demand in its half-yearly earnings report for FY24. The company reported that sales of new homes were approximately one-third lower than the previous year during the six months ended October 31, 2023. Despite the tough backdrop, the company extended its earnings guidance to April 2026, now targeting a minimum pre-tax profit of £1.5 billion.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

The earlier pre-tax profit goal was £1.05 billion for the two years ending in April 2025.

Berkeley is among the leading property developers in the UK, specializing in residential and commercial projects.

Resilient Performance

The UK’s housing market is grappling with a significant slowdown in 2023, impacted by interest rate hikes and high mortgage rates. Builders have been compelled to issue profit warnings and reduce their home-building targets in response to these challenges.

Berkeley also acknowledged that trading conditions continue to be tough. In response, the company intends to prioritize existing sites rather than pursuing new investments.

For the half-year period (ended on October 31, 2023), the company reported relatively stable revenue of £1.19 billion. The pre-tax profit saw a 4.6% increase, reaching £298.0 million. However, EPS experienced a slight decline of 1%, decreasing from 200.4p to 198.3p.

Regarding shareholder returns, Berkeley’s dividend experienced a substantial increase, more than doubling from 21p per share to 59p. The company also stated that it is on track to achieve £283 million (£2.67p) in shareholder returns by the end of September 2024.

Is Berkeley Group a Good Buy?

BKG shares traded down by around 4% on Friday after the results.

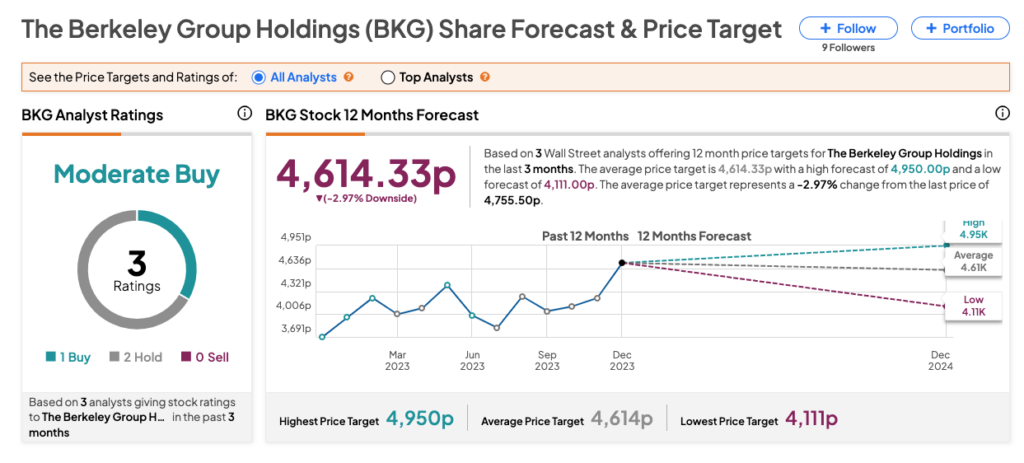

On TipRanks, BKG stock has received a Moderate Buy rating based on two Holds and one Buy recommendation. The Berkeley share price target is 4,614.3p, which is 3% lower than the current trading levels.