The SGX-listed Thai Beverage Public Company Limited (SG:Y92) reported a 9% decline in its annual profits, led by its beer and food segments. The net profit fell to ฿27.4 billion in the fiscal year 2023 compared to ฿30.1 billion a year ago. Among its segments, the company experienced a year-on-year 3% growth in attributable profit solely in its spirits business. On the other hand, its beer, non-alcoholic beverages, and food segments witnessed a decline in profits. The beer segment reported a decline of 33% in net profit to ฿5 billion.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

The company stated that factors like higher costs, brand investments, and competitive pressures weighed down on the beer business. Similarly, its food business experienced the impact of high operating expenses and other expenses associated with the opening of new stores.

Thai Beverage is well-known and one of the largest beverage companies in Asia. The company has a diverse portfolio that includes alcoholic and non-alcoholic beverages.

Q3 Results 2023

The revenue for the company grew by 3% to ฿279.1 billion, but was lower than the market estimates. The revenue was overall driven by favourable economic activities in Thailand. The operating profit declined by 9% to ฿29.4 billion, mainly due to higher distribution costs and other expenses. The total cost of sales increased by 2% to ฿196.3 billion.

In terms of the shareholders’ returns, the company announced a dividend of ฿0.45 per share for the full year, which was similar to the previous year’s payments. This final dividend will be paid on February 28, 2024, to its shareholders.

Is Thai Beverage a Good Buy?

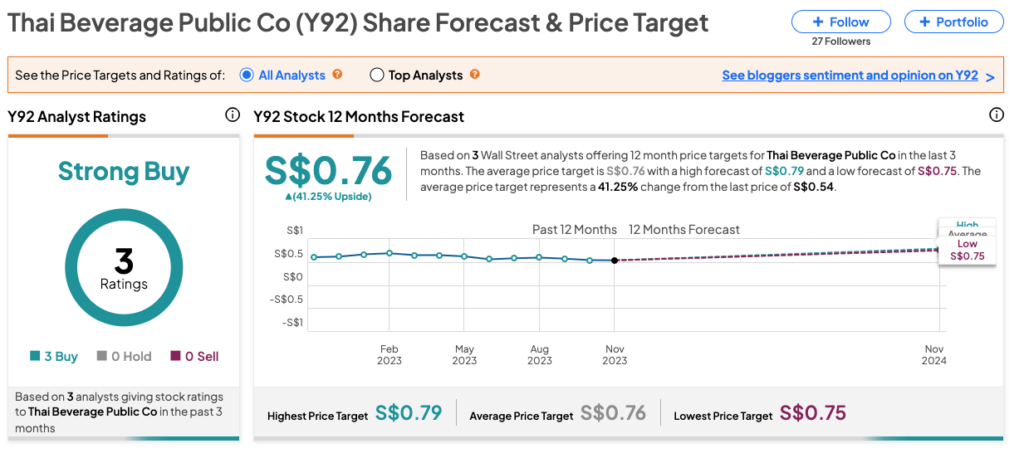

Year-to-date, the stock has incurred a loss of approximately 18% in trading, primarily influenced by higher costs that have adversely impacted its profitability. However, analysts remain bullish about the company and the stock, considering its dominant position in the market. The stock’s compelling long-term potential suggests a promising trajectory for investors.

Overall, Y92 stock has received a Strong Buy rating, backed by all three Buy recommendations. The ThaiBev share price forecast is S$0.76, which is 41.2% higher than the current trading levels.

It’s important to note that these ratings were updated before the latest results and are subject to change accordingly.