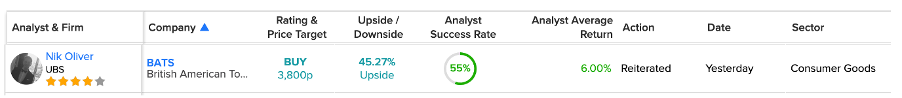

UK-based cigarette manufacturer British American Tobacco PLC (GB:BATS) yesterday received a Buy rating confirmation, which predicts more upside potential for the share price. Analyst Nik Oliver from UBS confirmed his Buy rating on the stock yesterday, predicting a 45% upside in the share price. Overall, the stock carries a Moderate Buy rating from analysts on TipRanks.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

The BATS share price has been struggling in 2023, with a loss of 18.3% in trading YTD. However, analysts are bullish about the stock, considering its powerhouse portfolio of non-combustible brands, which has the potential to drive robust growth in the future. Additionally, the company’s substantial dividends, which are backed by its profits, make it an ideal choice for income investors. The stock has a current dividend yield of 8.66%.

All Eyes on the Non-Combustible Market

The company’s lagging performance compared to its industry and its lackluster revenue results in the U.S. are points of worry. Nonetheless, the company maintains a positive outlook on its business transformation, affirming its guidance for the medium-term prospects of its new product business. By leveraging Vuse, the company’s vaping brand, it has upheld a robust stance, reinforcing its dominant position in the non-combustible market.

In its half-yearly earnings for 2023, the revenue generated from its New Categories division exhibited a growth of 26.6%, contributing to a cumulative 16.6% share of the group revenue for the first half of the year. The company also added 1.5 million new customers for its non-combustible products.

BAT maintains its optimism regarding the upward trajectory of its new product category, reportedly making progress towards achieving its target revenue of £5 billion by 2025. On the flip side, investors are likely evaluating whether the growth of BAT’s new products could lead to significant margin enhancement, even as the volume of combustible products is projected to continue declining.

Is BAT a Good Share to Buy?

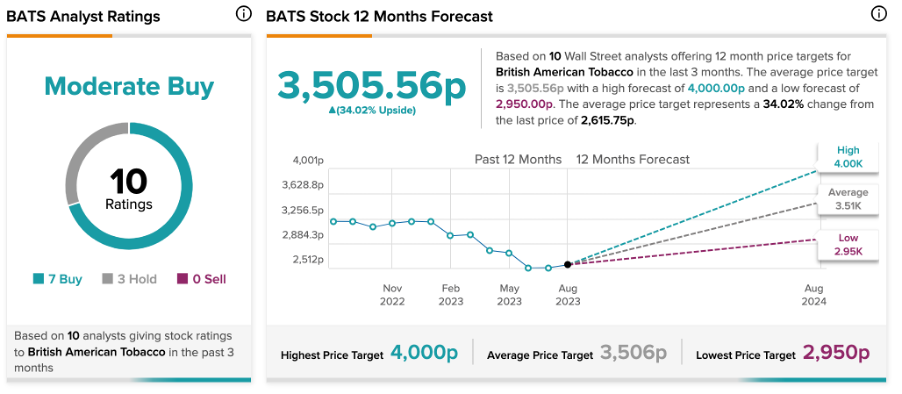

On TipRanks, BATS stock has a Moderate Buy rating backed by a total of 10 recommendations from analysts. It includes seven Buy versus three Hold ratings. The BATS share price prediction is 3,505.5p, which is higher than the current trading levels and implies a change of 34%.

Conclusion

Looking forward, Tobacco PLC is betting big on the non-combustible segment as its future growth driver. However, investors remain concerned about the margin outlook in the medium term as the company shifts away from combustible products.

Turning to analysts, they maintain an optimistic outlook and anticipate growth of over 30% for the BAT share price. Additionally, the appealing dividends make the case stronger for income investors.