The FTSE 100-listed Barclays PLC (GB:BARC) is targeting £1 billion in cost savings and is considering a reduction of its workforce by 2,000 jobs. As reported by Reuters, the potential cuts would be mainly at Barclays Execution Services, or BX unit. Barclays’ target of saving £1 billion would constitute approximately 7% of the bank’s underlying annual operating expenses, which amounted to £15 billion in 2022.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

This latest update follows the bank’s earlier announcement last month regarding the restructuring initiatives and unsatisfactory third-quarter numbers. The bank’s CEO, C. S. Venkatakrishnan (Venkat) indicated that the company was looking at options for structural cost-cutting ahead of its FY23 results and investor update on February 20, 2024.

Barclays is positioned among the top four leading banks in the U.K., catering to approximately 48 million customers worldwide. The bank offers a comprehensive range of services, including retail and corporate banking, wealth management, investment banking, and more.

Mounting Pressures

Since assuming the CEO role in November 2021, Venkat has been facing pressure from investors to enhance its book value. The bank’s share price experienced a decline of over 25% after he took charge.

In recent years, Barclays has undertaken various efforts to curtail its expenses by reducing bonuses and implementing job cuts in its retail and investment banking divisions. Nonetheless, this time, it is targeting cuts at BX, which witnessed a substantial increase in its staffing costs.

Additionally, Barclays has collaborated with Boston Consulting Group (BCG) for a comprehensive review. The focus of this review is to determine which segments of the business should be prioritized for investment and which should undergo reduction or potential divestment.

Is Barclays a Good Share to Buy?

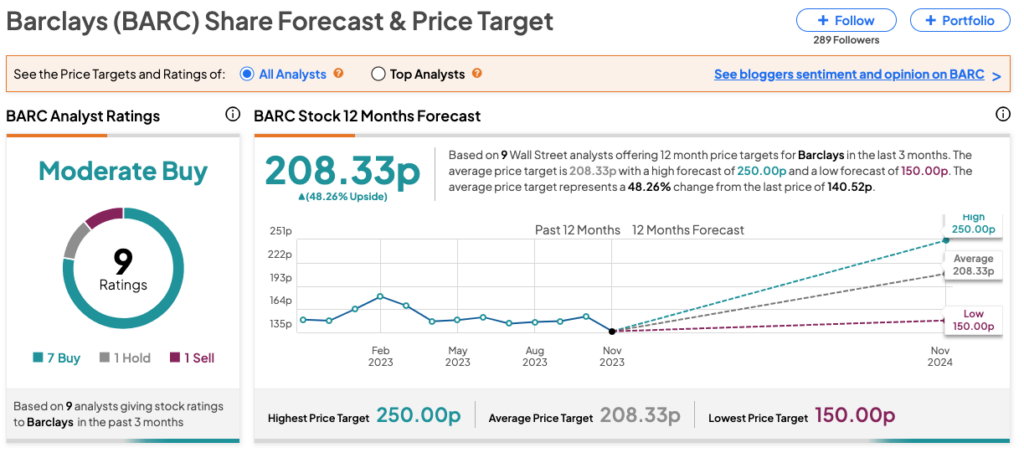

BARC stock has received a Moderate Buy rating on TipRanks, backed by seven Buys, one Hold, and one Sell rating. The Barclays share price forecast is 208.3p, which is 48.2% higher than the current trading level.