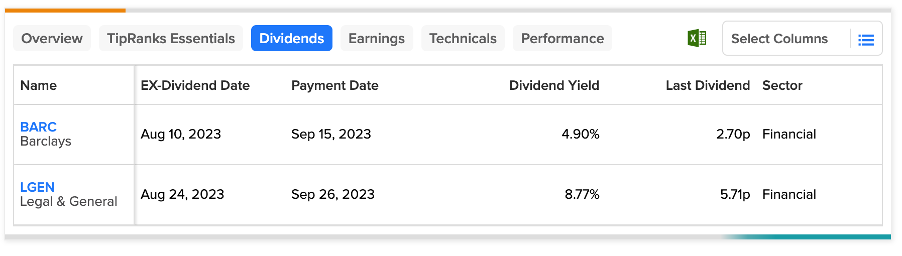

In today’s article, we will explore two UK stocks, Barclays PLC (GB:BARC) and Legal & General Group PLC (GB:LGEN), that are distributing their dividends this month. Barclays presently offers a substantial dividend yield of 4.9%, while Legal and General impressively boasts an even higher dividend yield of 8.7%. Both of these stocks outperform their respective sector average yields by a big margin.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Besides providing attractive dividends, both stocks have garnered Moderate Buy ratings from analysts, suggesting the potential for additional capital growth.

Let’s take a look at these two stocks in detail.

When Is Barclays Dividend Paid in 2023?

Barclays ranks among the top four leading banks in the UK, catering to approximately 48 million customers globally.

Barclays has declared a dividend of 2.7p for the first half of 2023, compared to 2.25p in the first half of 2022. This dividend will be disbursed on September 15, 2023, to shareholders listed as of August 11, 2023.

According to analysts, the bank is expected to distribute dividends of 8.6p per share in 2023, followed by an increase to 9.7p per share in 2024. Overall, the bank anticipates a favourable year ahead, with management indicating that net interest margins are projected to grow from 2.86% to a minimum of 3.2%. Furthermore, they are also foreseeing a return on tangible equity (ROTE) exceeding 10%.

Are Barclays Shares a Buy?

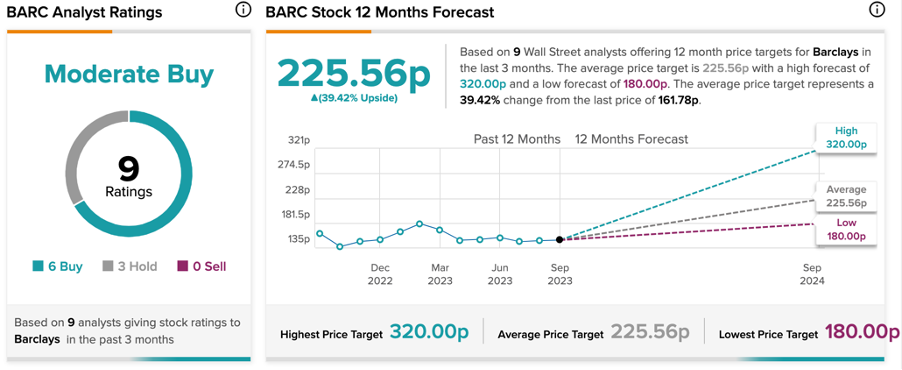

BARC stock has a Moderate Buy rating on TipRanks, backed by a total of nine recommendations from analysts, of which six are Buy. Analysts are highly bullish on the Barclays share price and predict growth of almost 40% at a price target of 225.56p.

When is the Next Legal & General Dividend?

Legal & General Group is a financial services firm based in the UK. It offers a range of products, including insurance, wealth management, savings, and investment solutions.

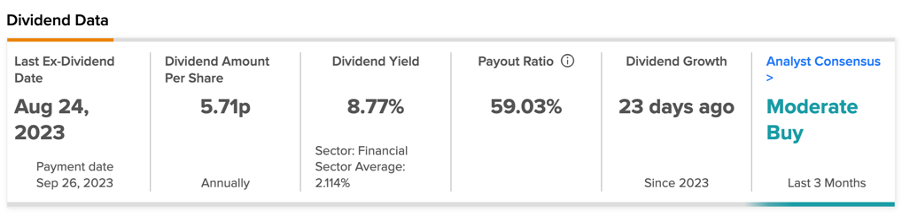

The company has declared an interim dividend of 5.71p per share, marking a 5% increase over the previous year’s interim payment of 5.4p. The dividend will be distributed on September 26, 2023, to shareholders who were recorded as of August 24. This dividend payment is in line with the company’s strategic objective of maintaining a consistent 5% annual growth in dividends until 2024.

Talking about the forecasts, Citi analysts expect the company’s dividend to increase to 20.33p per share in 2023 as compared to the 19.37p paid in 2022. Additional upticks to 21.35p and 22.51p are anticipated for 2024 and 2025, respectively, with support from an anticipated return to earnings growth.

Is Legal and General Stock a Good Buy?

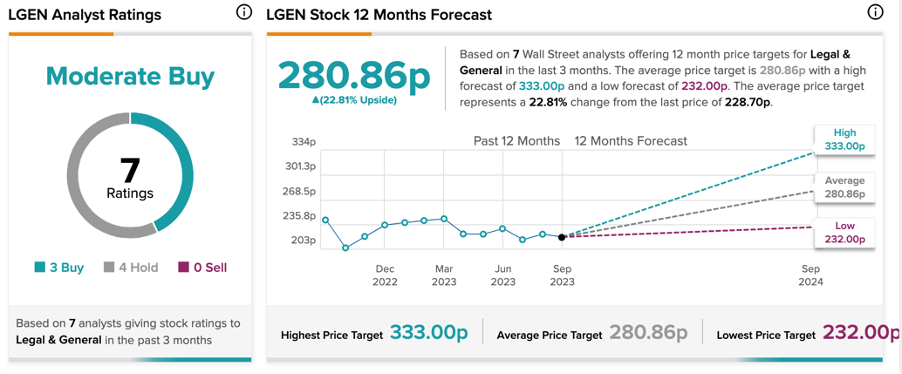

On TipRanks, LGEN stock has a Moderate Buy rating backed by three Buy and four Hold recommendations. The Legal and General share price prediction is 280.86p, which is 22.8% higher than the current price level.

Conclusion: LGEN and BARC Provide Steady Returns to Investors

Both LGEN and BARC are providing steady returns to their investors, and the Buy ratings from analysts further enhance the attractiveness of these stocks.